Smarter Taxes.

Higher Gains.

Avoid costly mistakes in your crypto tax return and keep more of your profits thanks to accurate tax calculation and easy-to-understand reports.

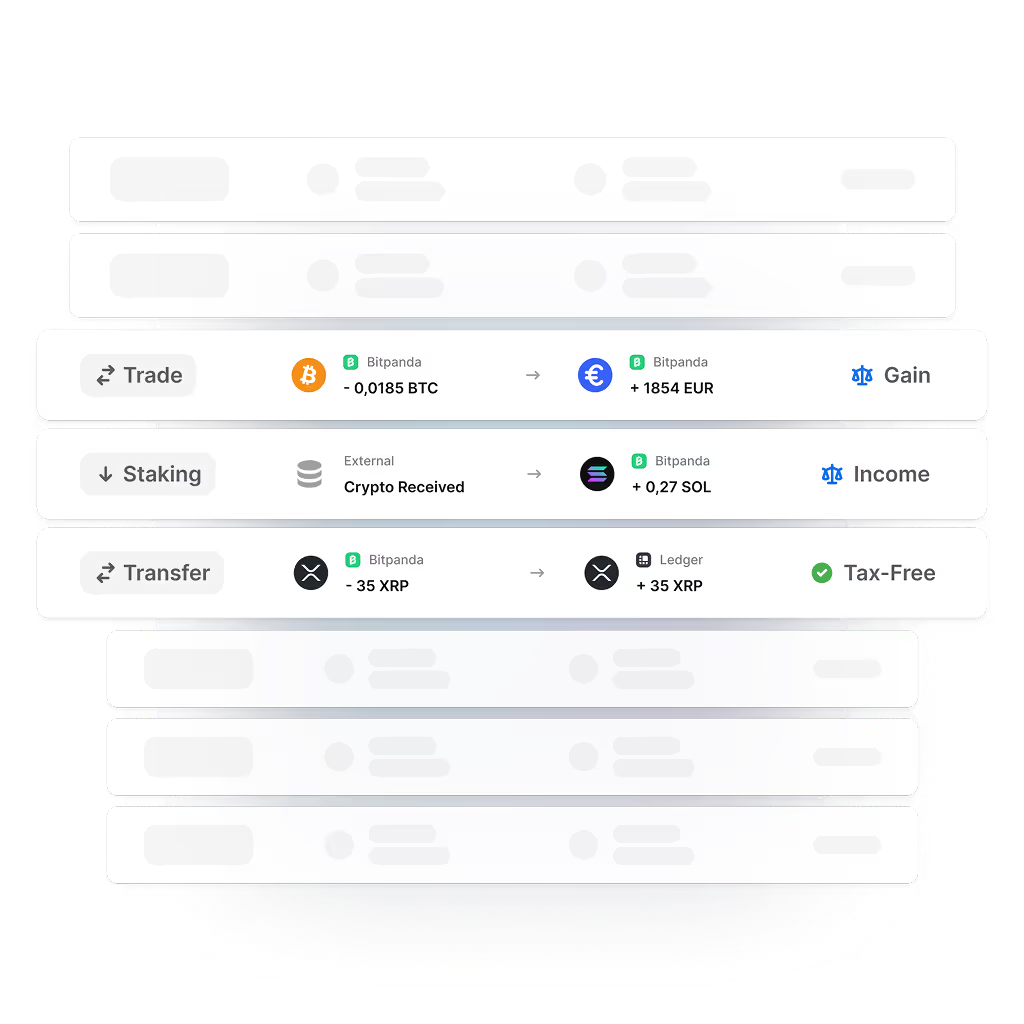

From chaos to clarity in three simple steps.

No second-guessing.

No surprises.

IRS Crypto Tax Rules

Blockpit calculates your crypto taxes according to official IRS guidelines, including short-term/long-term capital gains, holding periods and allowances.

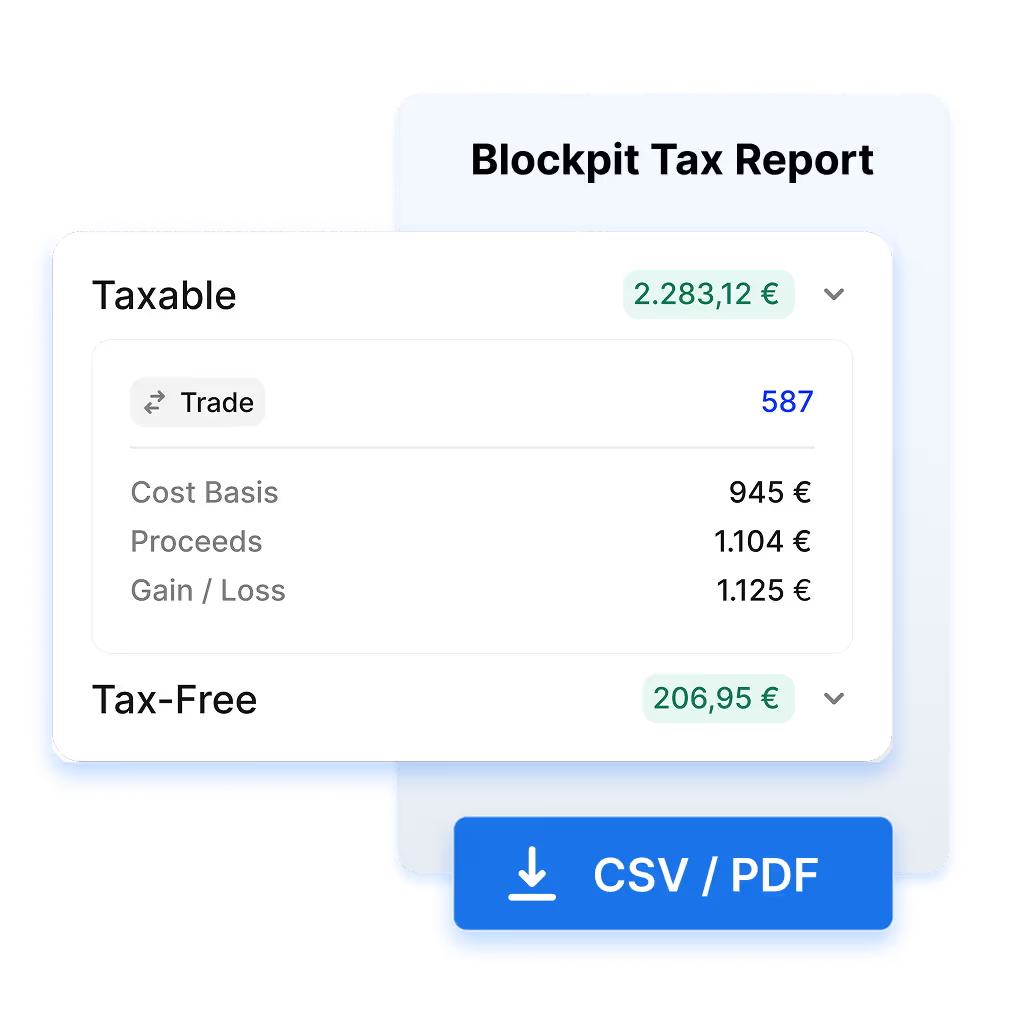

Ideal calculation

Blockpit helps you offset losses, identify tax-free gains, and keep more of your crypto profits.

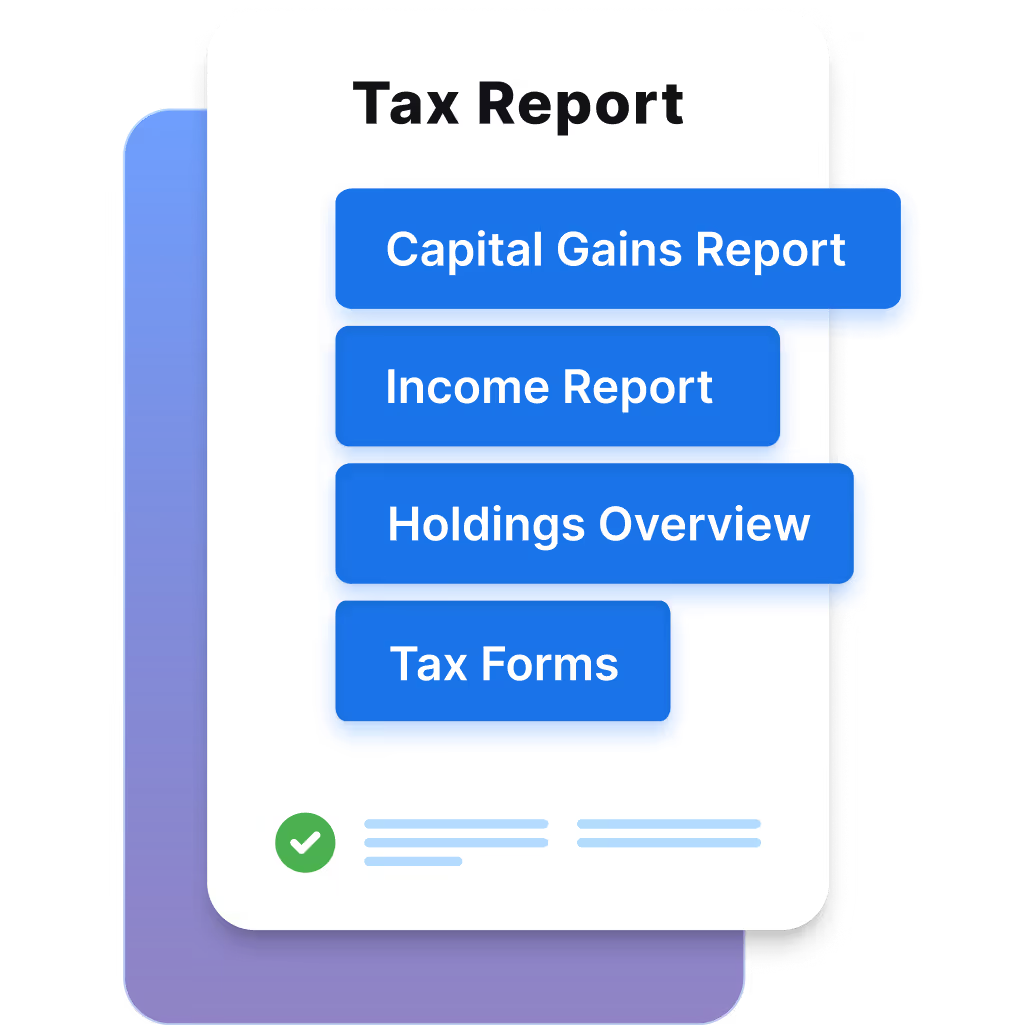

Ready-to-file

Your crypto tax report is complete, easy to understand and ready to be submitted – directly to the IRS or to your accountant.

File crypto taxes with total confidence.

One clear, compliant report with every relevant gain, loss, and detail your tax office needs.

There's a reason investors choose Blockpit.

Blockpit

Excel

Other Tax Tools

Tax Advisor

Full portfolio coverage

Automatic transaction import

Crypto Tax Rules

Complete tax reports

Tax optimization

Verifiability

Risk of user errors

Low

High

Medium

Very low

Ease of use

Depends

Cost

Flexible

Free

Flexible

High

Made for you

Community favorite

Recognized and awarded by top crypto communities as the go-to for effortless tax reporting and tracking.

IRS-ready

Blockpit reports accurately follow latest regulations set forth by the IRS and are trusted by users and authorities alike.

Built for trust

Developed to the highest standards of data protection and quality, backed by regular audits and continuous improvements.

Do you even have to pay tax on crypto?

Find out everything you need to know about crypto taxes in our expert guides!

What you should know

Blockpit is a crypto tax calculator that lets you track, analyze, and calculate your transactions in a tax-compliant way. The result: a ready-to-file crypto tax report.

You connect your wallets, exchanges, and protocols to Blockpit, and the tax engine calculates your gains and losses based on offical IRS tax rules. You'll receive an easy-to-understand tax report that you can submit to the tax office or share with your accountant.

Blockpit offers flexible pricing based on the number of transactions in each tax year. Portfolio tracking is free, and you can generate a tax report starting from $49 per tax year.

Yes. With Blockpit, you can generate tax reports for previous years at any time—retroactively and with the same level of detail as for the current year.