Partner with the leading Crypto Tax Tool

Blockpit cooperates with crypto exchanges, protocols, service providers, accountants, and communities to provide efficient crypto tax reporting globally.

Generous discounts for your audience

Flexible referral & revenue-share programs

Full support for UK crypto tax rules (HMRC)

Funded marketing campaigns

Partner with Blockpit

Leading Tax Solution

Blockpit provides country-specific crypto tax reporting, smart crypto tax optimisation and advanced portfolio tracking to hundreds of thousands of users worldwide.

Great Commission

Starting at 20% revenue share, even smaller affiliates can earn substantial rewards with single licence purchases of up to 529£. Request payout anytime with the click of a button.

Dedicated Support

We aim for long-time relationships, so we will actively foster our cooperation with expert content, joint campaigns and potential technical integration.

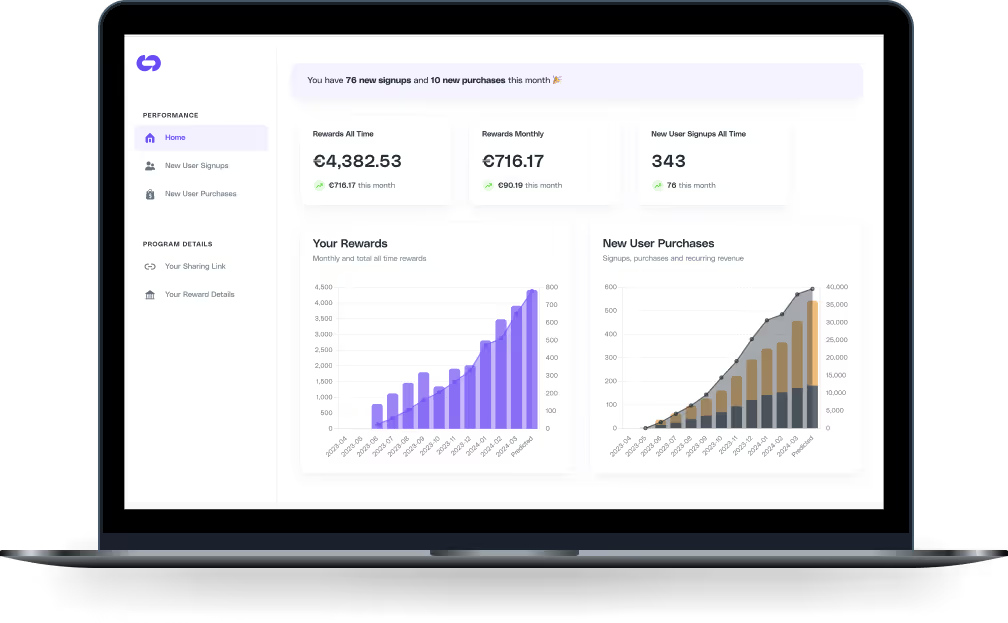

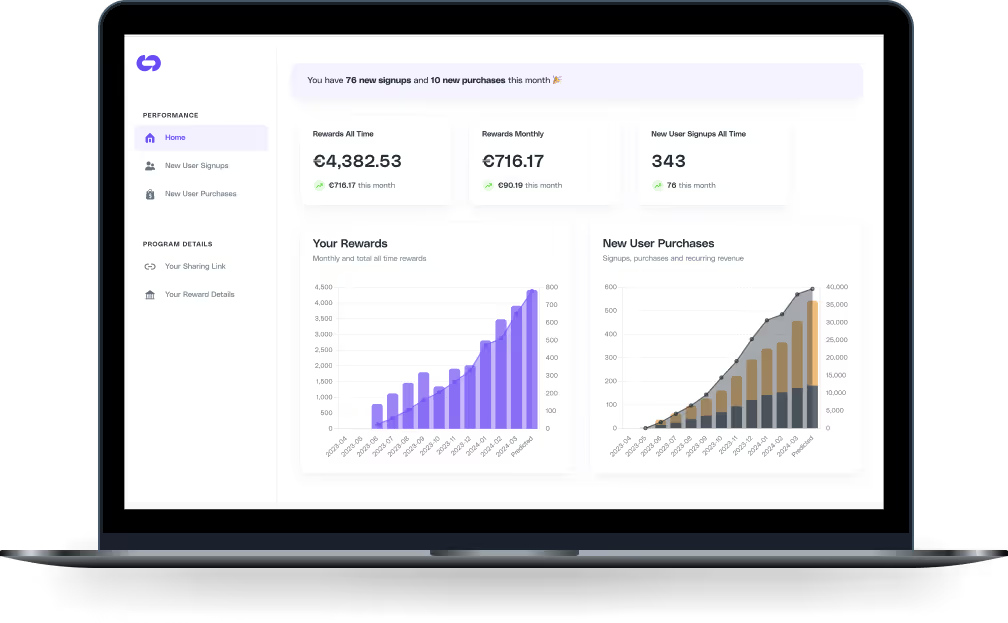

Partner Dashboard

Your own exclusive frontend, which gives all the facts and figures regarding our active partnership.

Quick and automated payouts via Paypal, initialize the process anytime.

Talk to Our Partner Manager

Any Questions?

Find answers to your most burning questions about a partnership with Blockpit.

Blockpit aims to partner with all major players in the crypto universe, whose users might face a tax challenge. This varies from:

- Exchanges

- BrokersWallet

- Providers / Custodians

- Protocols

- DApps

- Communities

- Influencers

- Accountants / CPAs

- Crypto Service Providers (e.g. Dashboards, Analytics)

Blockpit currently supports nine jurisdictions with a banking-grade tax framework, as well as a generic profit & loss report for all other countries (which use the FIFO-method for calculation).

Currently, it is possible to generate country-specific tax reports for the following countries:

- Austria

- Belgium

- France

- Germany

- Italy

- Netherlands

- Spain

- Switzerland

- UK (United Kingdom)

- USA

Further countries are added on an ongoing basis.

Let us know if you would like to see a specific report implemented. For countries not yet supported, we offer a generic P&L report.

Blockpit finances campaigns close to tax-season and year-end. A variety of services is available from expert content, dedicated tax guidelines, up to exclusive webinars with the Blockpit CEO and/or sponsored raffles (Licences, Token, NFTs, Bitcoin etc). Hit us up with your ideas!

Of course, we want all our partners to be convinced about the services we offer. We can unlock trial licences for aspiring partners and give lifetime licences to all active partners for their own usage.