Crypto Tax Reports for 100+ Countries

Blockpit's crypto tax reports are accepted around the world, providing international tax compliance for 100+ countries. Download our free sample tax report to see for yourself!

Detailed Tax Reporting

Capital Gains & Losses Report

Income Report

Holdings Report

Tax Optimization

Ready-to-File

Crypto Tax Forms

Blockpit's crypto tax reports include pre-filled, ready-to-file tax forms for the USA (IRS Form 8949 & 1040), the UK (HMRC Report), Germany (BMF Anlage SO & Anlage KAP), Austria (BMF Formular E1 & E1kv), Switzerland (FTA/ESTV Valuation Report), Italy (Agenzia Entrata Modello 730 & Redditi PF), France (DGFiP Formulaire n°2086 + n°2042 C), Spain (AEAT BOE Report), the Netherlands (Belastingdienst Report) and Belgium (SPF Report).

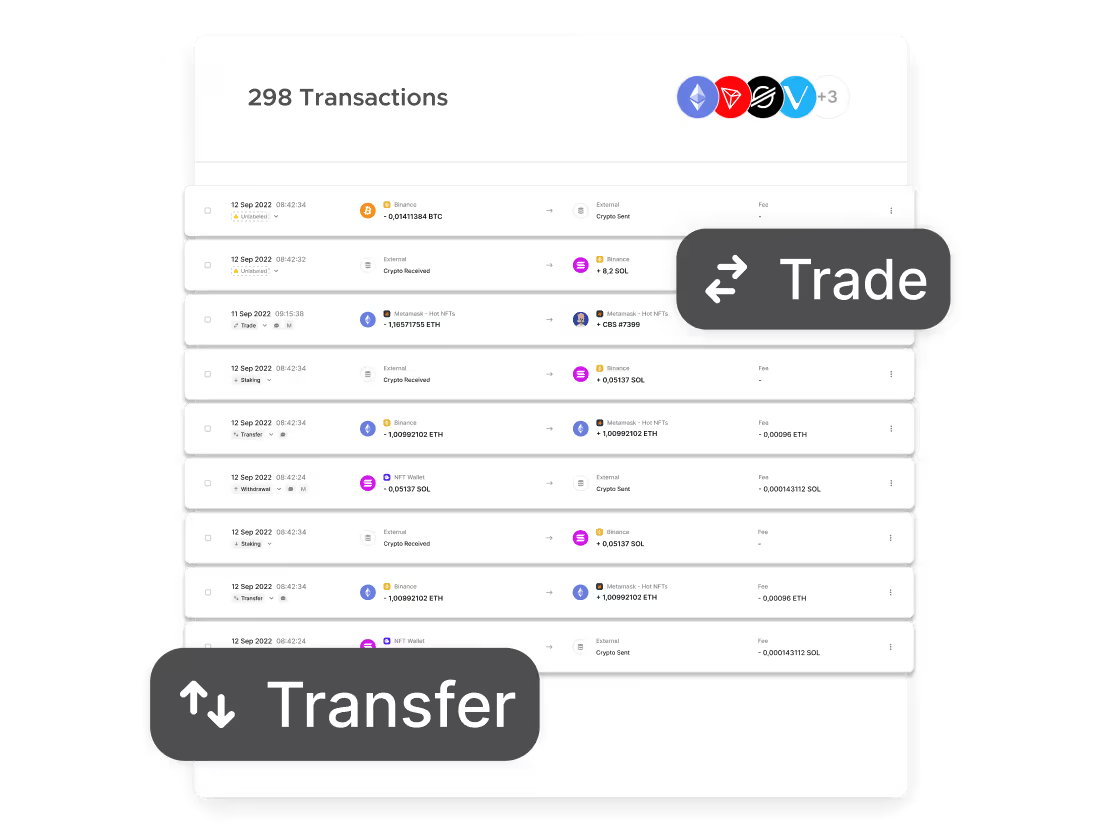

Effortless Crypto Tax Calculation

Generate country-specific crypto tax reports in 3 steps. It's that easy.

1. Import Transactions

Import your transaction history from your wallets and exchanges.

2. Review & Optimize

Gain new insights and discover actionable tax-saving opportunities.

3. Generate Tax Report

Click the button to download your complete crypto tax report.

Frequently Asked Questions

Find answers to your most burning questions about our crypto tax calculator.

Blockpit's tax reports are specific to a single tax year. Once you've purchased a license for that year, you can create and download reports as often as you need.

You can use Blockpit crypto tax reports in any country accepting the FIFO accounting method. We also support country-specific tax frameworks developed with KPMG in Germany, Austria, Switzerland, France, Spain, Italy, Belgium, the Netherlands, the UK, and the USA. More countries are added regularly.

Our highly skilled support team is ready to assist with any product-related issues. Additional help via video call can be booked here (additional fees may apply).

You can generate crypto tax reports for any year dating back to 2011.

All of our reports have been accepted without issues. Blockpit reports are widely recognized and trusted.

We don't. Our support team is always happy to assist with any questions you might have regarding our products. For individual tax advice, we partner with crypto tax experts worldwide – find one here.