Worried about tax mistakes?

Optimize your crypto taxes before year-end

Turn actionable insights into smarter decisions

Withdraw crypto stress-free

Is There a Crypto Tax in the UK?

Yes, cryptocurrencies are taxed in the UK despite being a relatively new asset class. If you hold cryptocurrencies like Bitcoin as a personal investment, dispose of them and make a profit, you must pay Capital Gains Tax on those profits. Additionally, if you earn cryptoassets through mining or as payment for services, you may be subject to Income Tax.

For detailed information on Bitcoin taxation in the UK, refer to our guide: Bitcoin Tax UK

Classification of Cryptocurrency for Tax Purposes

According to HMRC, cryptocurrencies (also called 'cryptoassets' or 'tokens') are digital assets protected by cryptographic techniques and can be transferred, stored, and traded electronically. HMRC identifies four main types:

- Exchange Tokens: Used for payments and investments, e.g., Bitcoin.

- Utility Tokens: Provide access to specific goods or services, often on DLT platforms.

- Security Tokens: Represent rights in a business, like ownership or profit claims.

- Stablecoins: Pegged to stable assets like fiat currency or gold to maintain value.

<div fs-richtext-component="info-box" class="info-box"><div class="flex-info-card"><img src="https://assets-global.website-files.com/65098a145ece52db42b9c274/650c6f4cef4c34160eab4440_Info.svg" loading="eager" width="64" height="64" alt="" class="icon-info-box"><div fs-richtext-component="info-box-text" class="info-box-content"><p class="color-neutral-800">Tax treatment depends on the token's nature and use, not its type. Be aware that tax guidelines for utility and security tokens may differ, though this distinction is not explicitly clarified yet.</p></div></div></div>

Capital Gains Tax for Crypto in the UK

Capital Gains Tax (CGT) applies to the profit made when you sell or dispose of an asset that has increased in value, including cryptocurrencies. Only the gain is taxed, not the total amount received.

<div fs-richtext-component="info-box" class="info-box"><div class="flex-info-card"><img src="https://assets-global.website-files.com/65098a145ece52db42b9c274/650c6f4cef4c34160eab4440_Info.svg" loading="eager" width="64" height="64" alt="" class="icon-info-box"><div fs-richtext-component="info-box-text" class="info-box-content"><p class="color-neutral-800">The UK offers an annual tax-free allowance called the Annual Exempt Amount. For the 2024/2025 tax year, the CGT exemption is reduced to £3,000, down from £6,000 in 2023/2024, allowing gains up to this amount to remain tax-free.</p></div></div></div>

If your gains exceed this allowance, you'll pay CGT on the excess. The rate varies based on your taxable income. Refer to the table below for rates applicable to disposals made on or after October 30, 2024.:

<figure class="block-table">

<table>

<tr>

<th>Tax Bracket</th>

<th>Income Range</th>

<th>CGT Rate on Assets</th>

</tr>

<tr>

<td>Basic Rate</td>

<td>Up to 50,270£</td>

<td>18%</td>

</tr>

<tr>

<td>Higher Rate</td>

<td>Up to 150,000£</td>

<td>24%</td>

</tr>

<tr>

<td>Additional Rate</td>

<td>Over 150,000£</td>

<td>24%</td>

</tr>

</table>

</figure>

Example: Capital Gains Tax

For example, if your annual income is 60,000£ and you've made a 10,000£ gain from selling Bitcoin:

1. Subtract the tax-free allowance from your gain:

10,000£ (gain) - 3,000£ (allowance) = 7,000£ (taxable gain).

2. As a higher-rate taxpayer, you pay 24% CGT on cryptocurrencies:

24% of 7,000£ = 1680£.

So, you would owe 1680£ in Capital Gains Tax on your Bitcoin sales.

Crypto Transactions That Fall Under Capital Gains Tax

What About Crypto Capital Losses?

Some trades result in capital losses, which you can offset against your gains to reduce taxes. You can register these losses on your self-assessment tax return indefinitely. It's best to register losses in the year they occur, but HMRC allows up to four years to do so. Even if your gains are low and below the tax-free allowance, it's wise to register losses to offset future gains.

Income Tax for Cryptocurrency

Any income from cryptoassets is subject to Income Tax. This includes payment for services, mining, or staking.

Report the value of the cryptocurrency in pounds at the time you receive it. For example, if you're a freelancer paid in Bitcoin, report your hourly rate in pounds.

<div fs-richtext-component="info-box" class="info-box protip"><div class="flex-info-card"><img src="https://assets-global.website-files.com/65098a145ece52db42b9c274/650c6f4b151815fb0be48cec_Lightning.svg" loading="eager" width="64" height="64" alt="" class="icon-info-box"><div fs-richtext-component="info-box-text" class="info-box-content"><p class="color-neutral-800">Tracking crypto income and its value can be challenging. Use Blockpit, a free crypto portfolio tracker, to simplify the process.</p></div></div></div>

Crypto mining and staking taxes vary:

- Professional activity: If your mining is considered a business, profits are taxed under trading income rules. This applies if you have significant equipment or energy costs and the intention to make a profit.

- Casual activity: If your mining or staking is casual, earnings are taxed as miscellaneous income.

Check if your crypto activity is considered a trade: UK Crypto Tax – Investor or Trader?

Tax rates depend on your overall income for the tax year. Refer to the tax rate table for specifics.

<figure class="block-table">

<table>

<tr>

<th>Tax Bracket</th>

<th>Income Range</th>

<th>Income Tax Rate</th>

</tr>

<tr>

<td>Personal Allowance</td>

<td>Up to 12,570£</td>

<td>0%</td>

</tr>

<tr>

<td>Basic Rate</td>

<td>12,571£ – 50,270£</td>

<td>20%</td>

</tr>

<tr>

<td>Higher Rate</td>

<td>50,271£ – 125,140£</td>

<td>40%</td>

</tr>

<tr>

<td>Additional Rate</td>

<td>Over 125,140£</td>

<td>45%</td>

</tr>

</table>

</figure>

<div fs-richtext-component="info-box" class="info-box protip"><div class="flex-info-card"><img src="https://assets-global.website-files.com/65098a145ece52db42b9c274/650c6f4b151815fb0be48cec_Lightning.svg" loading="eager" width="64" height="64" alt="" class="icon-info-box"><div fs-richtext-component="info-box-text" class="info-box-content"><p class="color-neutral-800">Be aware that income tax rates in the UK differ if you reside in Scotland.</p></div></div></div>

Example: Income Tax

- You're a freelancer with an annual income of 30,000£. You've also been paid 5,000£ worth of Bitcoin for a project.

- Add the Bitcoin earnings to your annual income. Your total income for the year is now 35,000£.

- Since 35,000£ is within the basic rate band, you'll pay 20% tax on the 5,000£ Bitcoin earnings. This equals 1,000£ in tax.

Crypto Transactions That Fall Under Income Tax

Learn more about Income Tax and Capital Gains Tax in our guide: UK Crypto Tax Rates

UK Cost Basis Methods

In cryptocurrency trading, HMRC mandates using specific cost basis methods for calculating capital gains and losses to prevent manipulation. These three methods have to be applied in the following order:

- Same-Day Rule: If you buy and sell the same cryptocurrency on the same day, the cost basis is the value of the assets on that day. If the quantity sold exceeds the quantity bought, proceed to the next rule.

- Bed and Breakfasting Rule: If you sell and repurchase the same cryptocurrency within 30 days, the cost basis is the value of the assets purchased within that period. If the quantity sold exceeds the quantity repurchased, move to the final rule.

- Section 104 Rule: When the previous rules don't apply, calculate an average cost basis for a pool of assets by dividing the total amount spent by the total quantity held.

Blockpit's Crypto Tax Calculator ensures full compliance by applying all three cost basis methods required by HMRC. Stay safe with Blockpit’s comprehensive tax reports!

Learn more about cost basis methods with easy to follow examples: UK Cost Basis Methods

From 2026, it gets serious: Tax authorities will receive your crypto data — CARF & DAC8

From 1 January 2026, the UK will implement the OECD’s Crypto-Asset Reporting Framework (CARF) into national law. This means crypto service providers will be required to systematically collect data on crypto activities. These data will be shared with other countries as part of the automatic international exchange of information, expected to start in 2027. As a result, tax authorities will gain much deeper insight into cross-border crypto transactions, significantly increasing transparency.

HMRC Crypto Tax Deadline

The tax year runs from 6th April to 5th April of the following year. HMRC deadlines for filing tax returns and paying taxes, including on cryptocurrency gains, are:

- Paper returns: Due by 31st October after the tax year ends (e.g., for the tax year ending 5th April 2025, the deadline is 31st October 2025).

- Online returns: Due by 31st January after the tax year ends (e.g., for the tax year ending 5th April 2025, the deadline is 31st January 2026).

How to Report Your Crypto Taxes to HMRC

Report your crypto gains or losses to HMRC through a Self Assessment tax return:

- Register: Sign up for Self Assessment on the HMRC website if you’re not already registered.

- Complete: Fill in the Capital Gains Summary pages, reporting all gains or losses, including cryptoassets.

- Submit: Submit your tax return online by 31st January after the tax year ends. Paper returns would need to be submitted by 31st of October.

- Pay: Pay any tax due by the same deadline.

<div fs-richtext-component="info-box" class="info-box protip"><div class="flex-info-card"><img src="https://assets-global.website-files.com/65098a145ece52db42b9c274/650c6f4b151815fb0be48cec_Lightning.svg" loading="eager" width="64" height="64" alt="" class="icon-info-box"><div fs-richtext-component="info-box-text" class="info-box-content"><p class="color-neutral-800">Blockpit generates comprehensive crypto tax reports in PDF format. These reports detail all your crypto gains, income, balances, and transactions, making them suitable as proof of origin for banks or tax advisors.</p></div></div></div>

How to Report Crypto on Tax Forms

To report your crypto activities to HMRC, complete two forms:

- SA100: HMRC Self-Assessment Tax Return for income from crypto.

- SA108: Self-Assessment Capital Gains Summary for crypto gains/losses.

<div fs-richtext-component="info-box" class="info-box"><div class="flex-info-card"><img src="https://assets-global.website-files.com/65098a145ece52db42b9c274/650c6f4cef4c34160eab4440_Info.svg" loading="eager" width="64" height="64" alt="" class="icon-info-box"><div fs-richtext-component="info-box-text" class="info-box-content"><p class="color-neutral-800">Note: The guidelines provided below focus specifically on your crypto activity and investments. If you have other income, capital gains, or losses to report, ensure they are included in the same form.</p></div></div></div>

Form SA100 – Self Assessment Tax Return

The SA100 form, the HMRC Self-Assessment Tax Return, covers income, capital gains, student loans, interest, and pensions. If declaring capital gains or losses, mark box 7 on the SA100 and include the SA108 form, the Capital Gains Summary.

On page 3 you find “Other UK income not included on supplementary pages”:

Box 17: Put in any income from crypto activity

Box 18: Expenses related to your crypto activity can be stated here

Box 21: Describe how you earned the income, e.g., "Income from crypto mining." Be as detailed as possible.

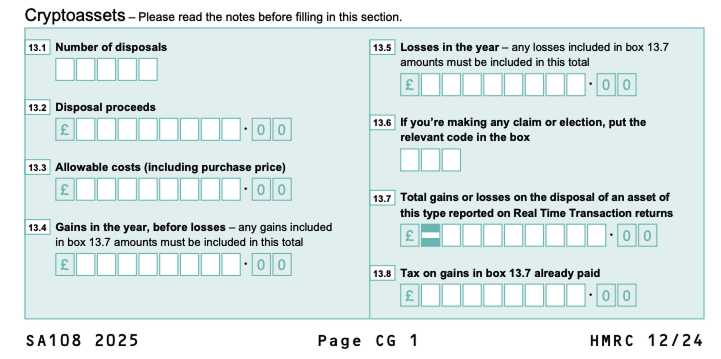

Form SA108 – Capital Gains Tax Summary

A dedicated cryptoassets section has been added to page 1 of form SA108. You need to complete boxes 13.1–13.8.

<div fs-richtext-component="info-box" class="info-box"><div class="flex-info-card"><img src="https://assets-global.website-files.com/65098a145ece52db42b9c274/650c6f4cef4c34160eab4440_Info.svg" loading="lazy" width="64" height="64" alt="" class="icon-info-box"><div fs-richtext-component="info-box-text" class="info-box-content"><p class="color-neutral-800">Tip: The Blockpit tax report clearly shows which figures belong in each box.</p></div></div></div>

After completing the initial section, go to 'Losses and adjustments' on page 3. If you have capital losses from previous years, income losses, or capital losses to carry forward, fill in boxes 45-48.

More Details can be found here: HMRC Crypto Tax Forms

How to File Your Taxes With Blockpit

As the UK's leading crypto tax firm, Blockpit offers a crypto tax calculator tailored for UK investors. Our software simplifies tax reporting by importing transaction data from exchanges and wallets, automatically calculating capital gains and losses. It provides real-time tax calculations and displays unrealised gains or losses.

For a detailed example, view our sample crypto tax report.

Optimising Your Crypto Taxes

In the UK, while hiding cryptocurrency from HMRC is unwise, savvy investors use legal strategies to reduce crypto taxes:

- Tax Loss Harvesting: Sell cryptocurrencies at a loss to offset gains and reduce taxable income.

- Carry Forward of Losses: Offset future gains with losses from previous years. Keep detailed records.

- Utilise Allowances: Realise gains within the annual tax-free capital gains allowance to avoid Capital Gains Tax.

- Consider Timing of Sales: Sell assets in a low-income year to reduce tax liabilities or stay in a lower tax bracket.

- Gift Cryptocurrency: Transfer crypto to a spouse or civil partner to utilise their tax allowance, especially if they are in a lower tax bracket.

- Donate Cryptocurrency: Reduce taxable income by donating appreciated crypto to charity. Deduct the market value of the donation.

- Use Crypto Tax Software: Simplify transaction tracking and ensure accurate tax calculations and deductions by using software like Blockpit.

- Consult a Tax Professional: Get customized guidance from a tax advisor with crypto experience to identify tax-saving opportunities and ensure compliance.

<div fs-richtext-component="info-box" class="info-box protip"><div class="flex-info-card"><img src="https://assets-global.website-files.com/65098a145ece52db42b9c274/650c6f4b151815fb0be48cec_Lightning.svg" loading="lazy" width="64" height="64" alt="" class="icon-info-box"><div fs-richtext-component="info-box-text" class="info-box-content"><p class="color-neutral-800">Access Blockpit’s Crypto Tax Optimizer for seamless Tax Loss Harvesting, with visual insights into unrealized gains, tax-free assets, and a Sell Simulation feature - available exclusively at Blockpit.</p></div></div></div>

Dive deeper:

How to optimise, reduce and (legally) avoid crypto taxes in the UK

Taxation of Basic Crypto Transactions

Selling Crypto for Fiat

<div fs-richtext-component="tax-status-capital-gains-tax" class="tax-status-pills"><div>Capital Gains Tax</div></div>

Selling cryptocurrency for fiat (like pounds or dollars) in the UK is a taxable event, subject to Capital Gains Tax on the profit made (the difference between the purchase and sale price).

Investing vs. Trading:

- Investing: Buying and holding crypto for long-term gains is subject to Capital Gains Tax.

- Trading: Frequent, short-term buying and selling for profit is classified as trading, subject to Income Tax, which can be higher than Capital Gains Tax.

HMRC assesses whether you're trading or investing based on factors like transaction frequency, organization level, and intent to profit from market fluctuations. This is evaluated case-by-case. Learn more about it here: Crypto Investor vs. Crypto Trader

<div fs-richtext-component="info-box" class="info-box protip"><div class="flex-info-card"><img src="https://assets-global.website-files.com/65098a145ece52db42b9c274/650c6f4b151815fb0be48cec_Lightning.svg" loading="eager" width="64" height="64" alt="" class="icon-info-box"><div fs-richtext-component="info-box-text" class="info-box-content"><p class="color-neutral-800">General Rule: Most individual investors will be subject to Capital Gains Tax.</p></div></div></div>

Trading Crypto for Crypto

<div fs-richtext-component="tax-status-capital-gains-tax" class="tax-status-pills"><div>Capital Gains Tax</div></div>

Trading one cryptocurrency for another, including stablecoins, is a taxable event in the UK. HMRC considers this as 'disposing' of an asset, triggering Capital Gains Tax.

Spending Crypto on Goods and Services

<div fs-richtext-component="tax-status-capital-gains-tax" class="tax-status-pills"><div>Capital Gains Tax</div></div>

Spending cryptocurrency on goods and services is a taxable event in the UK. HMRC views cryptocurrency as an asset. Using crypto to buy something is considered 'disposing' of the asset, triggering Capital Gains Tax.

Gifting Crypto

<div fs-richtext-component="tax-status-capital-gains-tax" class="tax-status-pills"><div>Capital Gains Tax</div></div> <div fs-richtext-component="tax-status-tax-free" class="tax-status-pills tax-free"><div>Tax Free</div></div>

Gifting cryptocurrency can be a taxable event in the UK. HMRC views gifting crypto as 'disposing' of an asset, triggering Capital Gains Tax on the difference between the purchase price and the market value at the time of the gift.

Spouse/Civil Partner Exception: Transfers between spouses or civil partners aren't subject to Capital Gains Tax at the time of the gift. The recipient inherits the original cost basis and will owe tax if they later dispose of the crypto.

Mining Crypto

<div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>Income Tax</div></div>

Mining cryptocurrency is a taxable event in the UK. HMRC treats mined cryptocurrency as income. The value at the time of mining is subject to Income Tax. Record the market value in pounds on the date of receipt.

If you later sell or exchange the mined cryptocurrency at a higher value, the profit is subject to Capital Gains Tax.

<div fs-richtext-component="info-box" class="info-box warning"><div class="flex-info-card"><img src="https://assets-global.website-files.com/65098a145ece52db42b9c274/650c6f473e84badfdd6e059e_Care.svg" loading="eager" width="64" height="64" alt="" class="icon-info-box"><div fs-richtext-component="info-box-text" class="info-box-content"><p class="color-neutral-800">Watch out: Extensive, profit-driven mining operations may be classified as a trade by HMRC, affecting tax implications.</p></div></div></div>

Learn more about crypto mining in the UK in our guide: UK Crypto Mining Taxation.

Airdrops

<div fs-richtext-component="tax-status-tax-free" class="tax-status-pills tax-free"><div>Tax Free</div></div>

As airdrops are usually received without providing any service or for business operations, no Income Tax is owed (otherwise see "Bounties" below).

Capital Gains Tax: If you sell or exchange the airdropped tokens at a higher value, the profit is subject to Capital Gains Tax.

Learn more about this topic: UK Airdrop Taxation.

Bounties

<div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>Income Tax</div></div>

A bounty is an airdrop received as a reward for a service. It is subject to Income Tax based on the value at the time received.

Capital Gains Tax: If you sell or exchange the tokens received as a bounty at a higher value, the profit is subject to Capital Gains Tax.

Hard Forks

<div fs-richtext-component="tax-status-tax-free" class="tax-status-pills tax-free"><div>Tax Free</div></div>

According to HMRC, the occurrence of a hard fork does not count as a disposal of the original cryptocurrency, so no immediate tax is due.

The costs associated with acquiring the original cryptocurrency must be divided between the original and new cryptocurrencies. This is necessary for calculating gains or losses when you eventually sell or exchange either cryptocurrency.

Receiving Crypto as a Gift

<div fs-richtext-component="tax-status-tax-free" class="tax-status-pills tax-free"><div>Tax Free</div></div>

Receiving cryptocurrency as a gift generally does not trigger immediate tax liability.

If you later sell, exchange, or dispose of the cryptocurrency, you may owe Capital Gains Tax on any increase in value since you received it.

Inheritance Tax: If the total value of gifts given by an individual within seven years before their death exceeds the Inheritance Tax threshold (£325,000), Inheritance Tax may be due, including on cryptocurrency.

Lost or Stolen Cryptoassets

<div fs-richtext-component="tax-status-tax-free" class="tax-status-pills tax-free"><div>Potentially Tax Deductable</div></div>

Losing access to cryptoassets due to a misplaced private key does not count as a disposal for Capital Gains Tax since the private key and tokens still exist on the ledger.

Negligible Value Claim: If the private key is irrecoverable, you may file a negligible value claim. If HMRC accepts, it treats the tokens as disposed of and reacquired at negligible value, allowing you to realize a loss for tax purposes.

For detailed information, refer to HMRC guidance documents CG13155 and CRYPTO22500.

Cryptocurrency as Employment Income

<div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>Income Tax</div></div>

When cryptocurrency is received as employment income, HMRC treats it like a salary. The employer must calculate its value in pounds at the time received, which is subject to Income Tax and National Insurance.

Employer Responsibilities: Report through PAYE and deduct necessary taxes before transferring the cryptocurrency to the employee.

Employee Responsibilities: Keep records of the cryptocurrency received and its value in pounds, ensuring employer compliance with tax obligations.

Cryptocurrency as Self-Employment Income

<div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>Income Tax</div></div>

For the self-employed receiving cryptocurrency as payment, report it as self-employment income. Maintain records of all transactions and their value in pounds at the time of receipt.

- Tax Return: Include details in your Self Assessment tax return. Deduct business-related expenses, but keep thorough records.

- Record Keeping: Keep separate records for cryptocurrency transactions to simplify reporting.

Taxation of DeFi Transactions

Staking & Lending Crypto

HMRC's updated Cryptoasset Manual outlines tax implications for DeFi transactions:

Disposal for Tax Purposes: Lending or staking cryptoassets and receiving other tokens is considered a disposal if the beneficial interest is transferred. Capital Gains Tax may be owed if the asset's value has increased.

Nature of Returns: Returns from lending or staking are not considered interest. Their tax treatment depends on whether they are capital (subject to Capital Gains Tax) or revenue (subject to Income Tax).

In summary, DeFi lending or staking is generally a taxable disposal, with tax treatment of returns based on the transaction specifics.

We’ve written a full guide to help you navigate staking taxes: UK Staking Taxation

Liquidity Mining Rewards

<div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>Income Tax</div></div>

HMRC may classify liquidity mining rewards as income, especially if the returns are predetermined and regularly paid by the platform.

- Income Tax: Regularly received tokens are likely considered earned income, subject to Income Tax. Calculate their value in pounds at receipt.

- NICs: You may owe National Insurance Contributions if classified as self-employment earnings.

- Capital Gains Tax: Selling the tokens later may incur Capital Gains Tax on any profit made.

- Staking Rewards: Rewards from staking liquidity provider tokens are also likely considered income and taxed accordingly.

Adding or Removing Liquidity

<div fs-richtext-component="tax-status-capital-gains-tax" class="tax-status-pills"><div>Capital Gains Tax</div></div>

When you invest in liquidity pools and receive LP tokens in return, HMRC considers this a disposal, potentially resulting in Capital Gains Tax on any profit made.

Cost Basis Calculation: Calculate the cost basis by summing the value of contributed tokens. Deduct this from the fair market value at the time of disposal.

Liquidity Pool Tokens: This calculated figure becomes the cost basis for your liquidity pool tokens, crucial for future withdrawals.

Taxation of NFT Transactions

Minting NFTs

<div fs-richtext-component="tax-status-tax-free" class="tax-status-pills tax-free"><div>Tax Free</div></div>

Minting NFTs is generally not considered a taxable event in the UK. The tax treatment primarily comes into play when NFTs are sold or otherwise disposed of.

Buying NFTs

<div fs-richtext-component="tax-status-tax-free" class="tax-status-pills tax-free"><div>Tax Free</div></div>

Simply buying an NFT does not incur immediate tax liability. You might need to pay VAT on the purchase price. This can be included in the price or added if buying from an international seller.

Selling NFTs

<div fs-richtext-component="tax-status-capital-gains-tax" class="tax-status-pills"><div>Capital Gains Tax</div></div>

Selling an NFT is subject to Capital Gains Tax (CGT) on the profit made, be it against fiat or cryptocurrency.

VAT: Generally, private individuals do not charge VAT when selling NFTs, but business-related sales might have different VAT rules.

Frequently Asked Crypto Tax Questions

Do I need to pay taxes on my crypto transactions in the UK?

Yes, you must pay taxes on certain crypto transactions. Profits from selling cryptoassets may incur Capital Gains Tax. Income from payments or mining is subject to Income Tax and National Insurance.

Is crypto taxed like stocks in the UK?

Yes, cryptoassets are taxed similarly to stocks, mainly through Capital Gains Tax. Differences include using pooling for calculating acquisition costs and specific events like hard forks and airdrops.

Which transactions are exempt from crypto taxes in the UK?

Holding cryptoassets, transferring them between your wallets, and gifting to a spouse or civil partner are not taxable. There is also an annual tax-free allowance.

How to know if you need to pay Crypto Capital Gains Tax?

Calculate the gain or loss for each transaction. Deduct certain costs, and offset losses against gains. Report if taxable gains exceed the annual allowance.

Do I have to report my cryptoassets to HMRC?

You don’t need to declare holdings, but you must report gains, losses, and income. Non-disclosure can result in penalties, interest, and criminal charges.

Can HMRC track cryptocurrencies and crypto transactions?

Yes, HMRC can track transactions using blockchain transparency, data from exchanges, and analysis tools. Exchanges must comply with data requests.

Do crypto exchanges report to HMRC?

Yes, UK exchanges share transaction data and user information with HMRC to ensure tax compliance. Accurate reporting of your transactions is crucial.

What happens if I don’t report crypto gains or losses?

Failing to report gains or losses can lead to penalties and interest charges. HMRC considers it tax evasion and may impose severe consequences.

Where can I find more information on crypto taxes in the UK?

Visit the HMRC website for official and detailed guidance on crypto taxes.

Helpful Links

https://www.gov.uk/hmrc-internal-manuals/capital-gains-manual/cg13155

https://www.gov.uk/hmrc-internal-manuals/cryptoassets-manual/crypto22500

https://www.gov.uk/hmrc-internal-manuals/cryptoassets-manual

https://www.gov.uk/hmrc-internal-manuals/cryptoassets-manual/crypto10200

https://www.gov.uk/hmrc-internal-manuals/cryptoassets-manual/crypto10100

https://www.gov.uk/scottish-income-tax

https://www.gov.uk/hmrc-internal-manuals/cryptoassets-manual/crypto22200

01/2026: Update for 2026

01/2025: Update for 2025

06/2024: Complete revision; new structure, texts and images

02/2024: Update for 2024