Worried about tax mistakes?

Optimize your crypto taxes before year-end

Turn actionable insights into smarter decisions

Withdraw crypto stress-free

<div fs-richtext-component="info-box" class="info-box"><div class="flex-info-card"><img src="https://assets-global.website-files.com/65098a145ece52db42b9c274/650c6f4cef4c34160eab4440_Info.svg" loading="lazy" width="64" height="64" alt="" class="icon-info-box"><div fs-richtext-component="info-box-text" class="info-box-content"><p class="color-neutral-800">This guide takes into account the new tax regulations that have been in effect since the Eco-Social Tax Reform of March 1, 2022.</p></div></div></div>

Do Cryptocurrencies Need to Be Taxed in Austria?

Yes, if you exchange cryptocurrencies for fiat money like the Euro and make a profit, a tax of 27.5% is applied to the gain. However, crypto-to-crypto exchanges remain tax-free.

<div fs-richtext-component="info-box" class="info-box"><div class="flex-info-card"><img src="https://assets-global.website-files.com/65098a145ece52db42b9c274/650c6f4cef4c34160eab4440_Info.svg" loading="lazy" width="64" height="64" alt="" class="icon-info-box"><div fs-richtext-component="info-box-text" class="info-box-content"><p class="color-neutral-800">Cryptocurrencies, including Bitcoin, Ether, and stablecoins like Tether, are defined as cryptocurrencies under § 27b Abs 4 EStG and are subject to these tax regulations. NFTs, on the other hand, are not considered cryptocurrencies, so different rules apply to them.</p></div></div></div>

What Is Old Stock (Altbestand) and New Stock (Neubestand) in Austria?

Since March 1, 2022, a new law has governed the taxation of cryptocurrencies in Austria, focusing on the purchase date of your assets:

- Cryptocurrencies purchased up to February 28, 2021 (old stock), can be sold tax-free after a one-year holding period, making all old stock now tax-exempt.

- Cryptocurrencies purchased after this date (new stock) are subject to a special tax rate of 27.5% when sold for fiat currency.

Special case: New stock cryptocurrencies sold before March 1, 2022, are subject to a progressive income tax rate of up to 55%.

<div fs-richtext-component="info-box" class="info-box"><div class="flex-info-card"><img src="https://assets-global.website-files.com/65098a145ece52db42b9c274/650c6f4cef4c34160eab4440_Info.svg" loading="lazy" width="64" height="64" alt="" class="icon-info-box"><div fs-richtext-component="info-box-text" class="info-box-content"><p class="color-neutral-800">Good to know: With the Eco-Social Tax Reform, crypto assets are treated as capitalassets for tax purposes. This means that cryptocurrencies are taxed like stocks, bonds, dividends, etc., and losses can be offset against gains from these other capital assets.</p></div></div></div>

How Much Tax Will You Have to Pay? (Example)

When you trade crypto for crypto, it does not trigger a tax liability, but the cost basis must be carried over. In a way, this allows you to defer taxation. Let's look at an example:

- Purchase of 1 BTC for 50,000€

- BTC rises to 70,000€

- Exchange of BTC for ETH (not a taxable event)

- The value of your ETH rises to 80,000€

- You sell half of it for 40,000€ (taxable)

How much tax will you have to pay?

To determine the tax due, subtract the cost basis from your sales proceeds. You sell half, so your cost basis is half of your original purchase cost of 1 BTC, which is 25,000€.

40,000€ - 25,000€ = 15,000€ profit.

27.5% of 15,000€ equals 4,125€ in taxes due.

<div fs-richtext-component="info-box" class="info-box protip"><div class="flex-info-card"><img src="https://assets-global.website-files.com/65098a145ece52db42b9c274/650c6f4b151815fb0be48cec_Lightning.svg" loading="lazy" width="64" height="64" alt="" class="icon-info-box"><div fs-richtext-component="info-box-text" class="info-box-content"><p class="color-neutral-800">With Blockpit's cryptocurrency tax software, such calculations are fully automated for you. The days of tediously keeping track of your crypto transactions in an Excel file are over. Good riddance.</p></div></div></div>

Automatic KESt Deduction for Cryptocurrencies: Easier, but Not Always Sufficient

Since January 1, 2024, domestic providers like Bitpanda and Coinfinity automatically deduct the capital gains tax (KESt) for all individuals residing in Austria. This significantly reduces the effort for many investors. However, a tax return may still be necessary if:

- Missing or incorrect acquisition costs: Implausible entries result in flat-rate calculations that need to be corrected.

- Loss offsetting: Offsetting losses with other capital gains is only possible via a tax return.

- Non-automated platforms or DeFi: Profits from foreign platforms like Binance or DeFi income must be declared manually.

A crypto tax calculator helps track transactions, utilize losses, and calculate taxes correctly. This ensures compliance while maximizing tax benefits.

Do I Need to Pay Taxes on Cryptocurrency Income?

The key question is whether cryptocurrency income should be taxed upon receipt or only when it is sold or exchanged.

Income is taxed at the time of receipt in transactions where you transfer your cryptocurrencies to other market participants (e.g., to a network or company). This can occur in activities like mining, lending, staking, liquidity mining, yield farming, or liquidity providing. In such cases, the tax rate is 27.5%.

<div fs-richtext-component="info-box" class="info-box"><div class="flex-info-card"><img src="https://assets-global.website-files.com/65098a145ece52db42b9c274/650c6f4cef4c34160eab4440_Info.svg" loading="lazy" width="64" height="64" alt="" class="icon-info-box"><div fs-richtext-component="info-box-text" class="info-box-content"><p class="color-neutral-800">The 27.5% tax rate is applied when there is a "public placement," which is typically the case in the DeFi sector. If there is no "public placement," taxation is instead carried out according to the progressive income tax rate.</p></div></div></div>

However, income from (delegated) staking, airdrops, bounty or affiliate rewards, or hard forks is not taxed at the time of receipt, and the acquisition costs are set at zero.

Regardless, any profit made from the later sale of such income is always taxed at 27.5%.

How Can You Optimize Taxes on Crypto Gains?

There are legal ways to minimize your tax burden on cryptocurrencies:

- Cryptocurrencies from old stock can be sold tax-free.

- Instead of exchanging cryptos for fiat currencies like EUR, you can convert them into stablecoins like USDT. This exchange is tax-free and protects against the high volatility of the crypto market while you enjoy the benefits of a stablecoin.

- You can offset crypto gains and losses with results from other capital market transactions (e.g., stocks, bonds, dividends, and derivatives) from the same tax year. More details: Deducting crypto losses.

- Be aware: Profits from margin or futures trading are typically classified as income from unlisted derivatives and are subject to the progressive income tax rate. Crypto disposals occur simultaneously: Realized capital gains from these transactions are taxed at a fixed rate of 27.5%.

- Remember the exemption limit of 440€ per year on gains from NFTs to avoid tax liability.

<div fs-richtext-component="info-box" class="info-box protip"><div class="flex-info-card"><img src="https://assets-global.website-files.com/65098a145ece52db42b9c274/650c6f4b151815fb0be48cec_Lightning.svg" loading="lazy" width="64" height="64" alt="" class="icon-info-box"><div fs-richtext-component="info-box-text" class="info-box-content"><p class="color-neutral-800">Pro Tip: With Blockpit's Crypto Tax Optimizer, included in Blockpit Plus, you can easily identify tax-free gains. By the way, Blockpit Plus is available for only 3,99€ monthly!</p></div></div></div>

What Is the Income Assessment and the Average Cost Basis (ACB)?

For tax purposes, the basis of assessment in the case of disposal is the difference between the sale proceeds and the acquisition costs, including any associated costs. That is the income assessment.

In the case of exchanging one cryptocurrency for another, the fair market value of the exchanged cryptocurrency is considered as the sale proceeds.

If cryptocurrencies are purchased sequentially and stored in the same cryptocurrency address, they must be valued according to the Average Cost Basis (ACB) as per the BMF Cryptocurrency Ordinance, and always in euros according to general tax principles.

Income from realized gains accruing from January 1, 2023, must be calculated using the ACB.

Items not included in the ACB:

- Old stock; if both old and new stocks are present, the taxpayer can choose how to allocate them at the time of disposal.

- Cryptocurrencies for which acquisition costs were set at a fixed rate during the capital gains tax deduction.

- For disposals on December 31, 2022, and earlier, the First In, First Out (FIFO) method or even a specific allocation of tranches—if clearly substantiable—is applicable.

How Do I File My Tax Return for Cryptocurrencies?

You can submit your tax return digitally via FinanzOnline or in paper form by mail. The Ministry of Finance provides an overview of relevant tax forms.

When Must I File My Tax Return for My Cryptocurrency Gains?

Generally, a tax return is always filed for the previous year. So, if you wish to file your tax return for 2024, you can do so starting in 2025. The submission method significantly affects the deadlines for annual tax returns in Austria:

- Earliest submission: Mid-February of the following year

- In paper form: Until April 30th of the following year

- Online: Until June 30th of the following year

- Via a tax advisor: Extensions can be requested

<div fs-richtext-component="info-box" class="info-box"><div class="flex-info-card"><img src="https://assets-global.website-files.com/65098a145ece52db42b9c274/650c6f4cef4c34160eab4440_Info.svg" loading="lazy" width="64" height="64" alt="" class="icon-info-box"><div fs-richtext-component="info-box-text" class="info-box-content"><p class="color-neutral-800">The deadlines for submitting tax returns online and in paper form can be extended upon a justified request. An extension request can be easily submitted electronically via FinanzOnline (under "Weitere Services/Fristverlängerung"). Additional extensions are available for applications made through a tax advisor or corporate fiduciary.</p></div></div></div>

Crypto Tax Software: How Blockpit Automates Your Crypto Tax Filing

If you've ever filed a tax return, you know how much time can be spent on research, documentation, and preparation. Blockpit's legally compliant tax reports not only save you a great deal of time but also provide a comprehensive overview of all your crypto transactions, giving you exactly what you need: a legally compliant PDF that can be easily submitted to the tax office.

For full details, here is the complete PDF of our example crypto tax report.

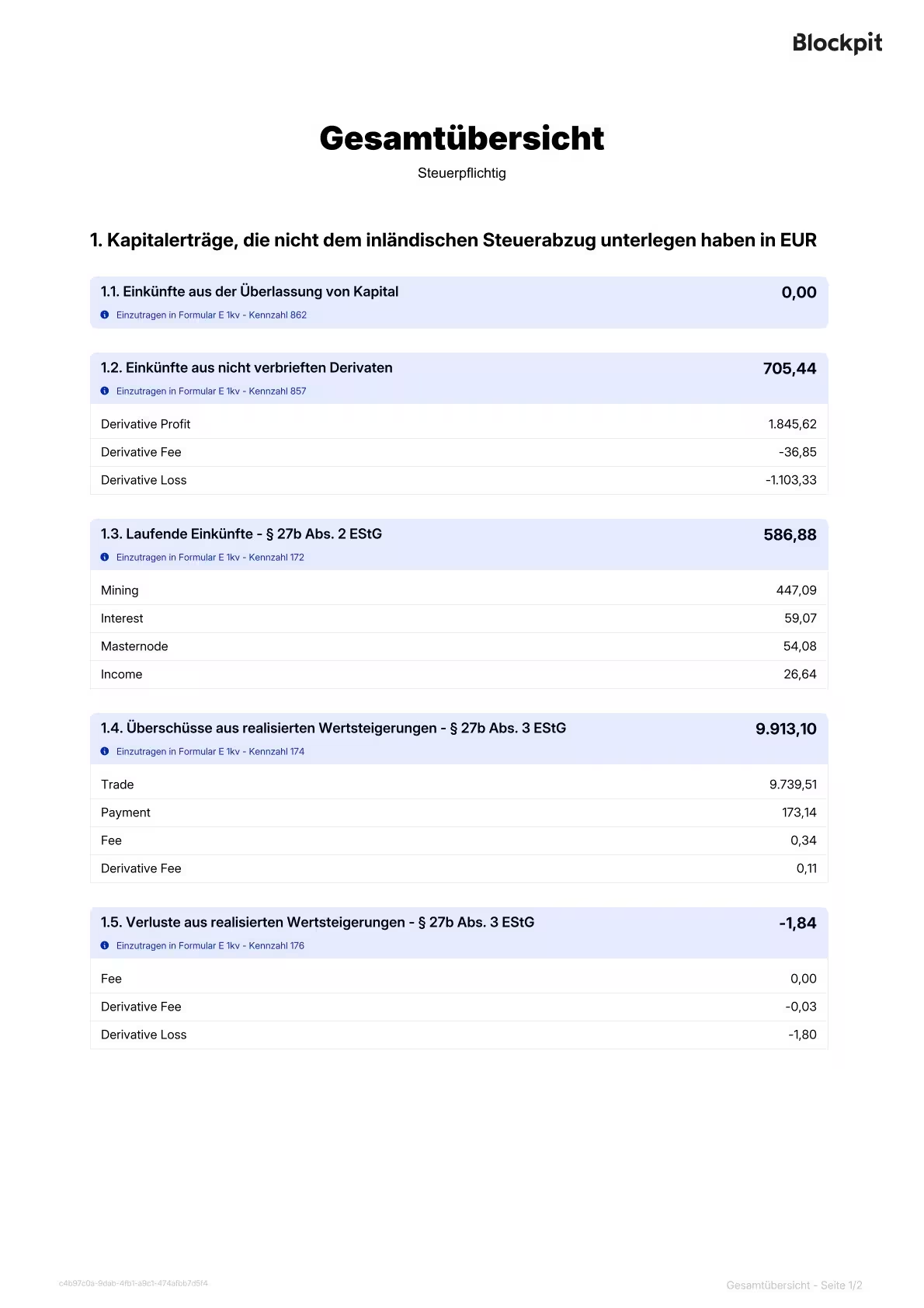

Overview of the Crypto Tax Report

Right from the start, you get an overview of your income from speculative transactions and services, as well as capital gains related to cryptocurrencies.

Income Tax Return Form

Next, you'll find the appropriate form from the Federal Ministry of Finance (BMF) for submitting your income tax return. Conveniently, Blockpit not only calculates the amounts you need to declare but also automatically enters them into the correct fields for you.

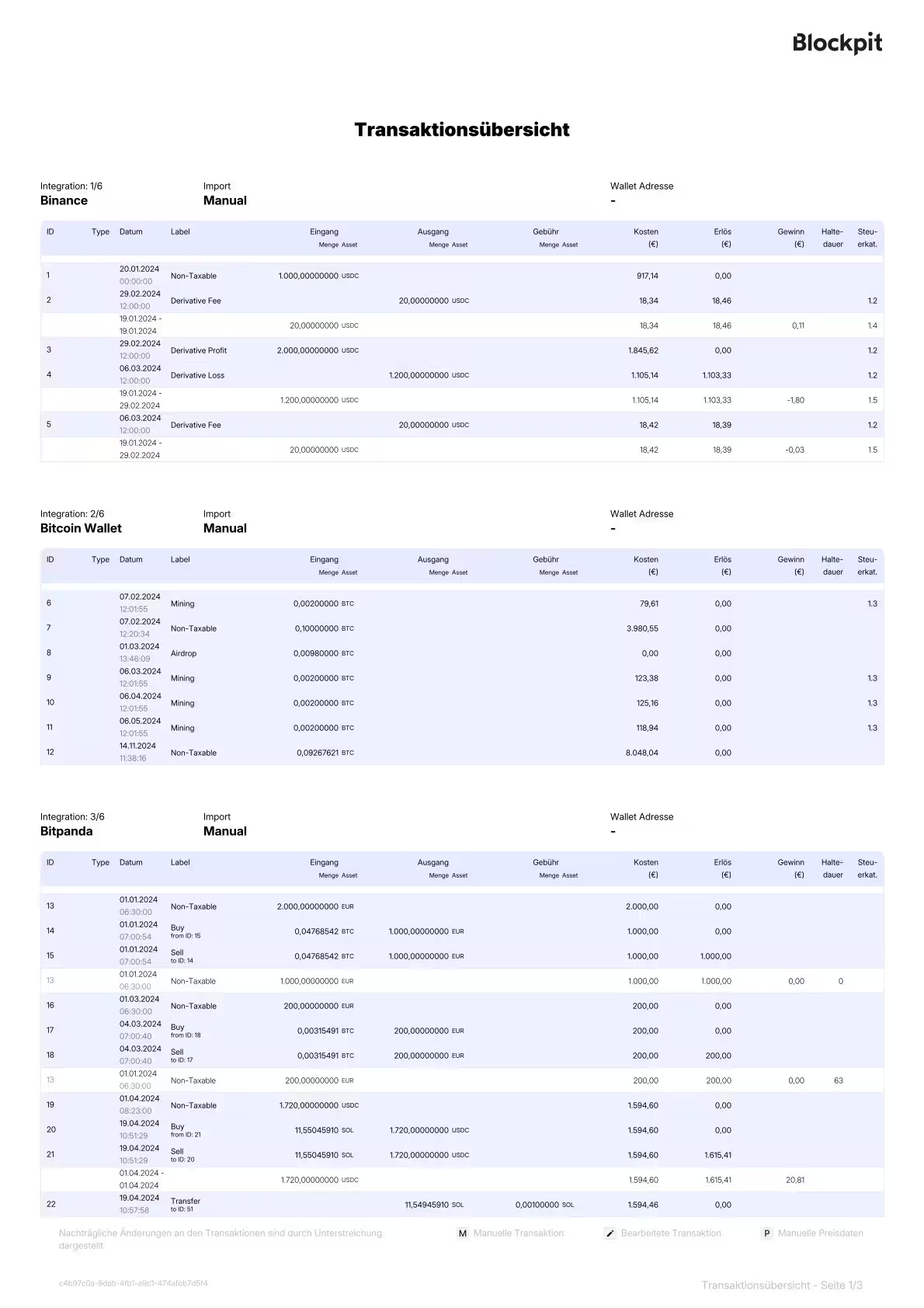

Detailed Transaction Listing

With a precise list of all your transactions, you can keep a complete record of your crypto activities throughout the year. This is excellent for manual checks and also serves as a helpful documentation tool for any inquiries you may receive.

When Are Crypto Transactions Tax-Free?

Any old stock (purchased before February 28, 2021) is now tax-free.

You also remain tax-free when:

- Purchasing cryptocurrencies with fiat money

- Exchanging cryptocurrencies with each other (e.g., BTC → ETH)

- Transferring cryptocurrencies between your wallets

- Holding (HODLing) your cryptocurrencies without selling

- Donating or gifting cryptocurrencies

- Income from (delegated) staking, airdrops, bounties, or hard forks is not taxed at receipt and thus does not generate taxable income

<div fs-richtext-component="info-box" class="info-box"><div class="flex-info-card"><img src="https://assets-global.website-files.com/65098a145ece52db42b9c274/650c6f4cef4c34160eab4440_Info.svg" loading="lazy" width="64" height="64" alt="" class="icon-info-box"><div fs-richtext-component="info-box-text" class="info-box-content"><p class="color-neutral-800">Good to know: Gifts are always tax-free. A report of gifting is required for strangers for amounts over 15,000€ and for family members over 50,000€.</p></div></div></div>

<div fs-richtext-component="info-box" class="info-box protip"><div class="flex-info-card"><img src="https://assets-global.website-files.com/65098a145ece52db42b9c274/650c6f4b151815fb0be48cec_Lightning.svg" loading="lazy" width="64" height="64" alt="" class="icon-info-box"><div fs-richtext-component="info-box-text" class="info-box-content"><p class="color-neutral-800">Since the exchange of crypto-to-crypto has been tax-free since March 1, 2022, you can carry forward your gains over the years. Simply convert them into a stablecoin like USDT or USDC. A taxable event is triggered only when you, for instance, cash out in euros. This strategy also helps active traders manage the volatility in the crypto market.</p></div></div></div>

Crypto-to-Crypto Exchange

<div fs-richtext-component="tax-status-tax-free" class="tax-status-pills tax-free"><div>Tax Free</div></div>

The exchange of crypto for crypto is tax-free. The cost basis is carried over in a crypto-to-crypto exchange.

Crypto-to-Fiat Exchange

<div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>27,5% on sale</div></div>

Exchanging cryptocurrencies for fiat money, such as the Euro, incurs a tax of 27.5% on potential gains.

Airdrops

<div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>27,5% on sale</div></div>

Airdrops do not constitute income. They are primarily issued to promote newly launched projects in the blockchain technology sector and are transferred to a wallet for free without any reciprocal service. Therefore, the acquisition costs are set at zero. If you sell airdrop gains, you must apply a tax rate of 27.5% at the time of sale.

Futures/Margin Trading with Cryptocurrencies

<div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>Progressive Income Tax</div></div> <div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>27,5% on sale</div></div>

When taxing margin or futures trading, two distinct processes must be differentiated:

- Profits from margin or futures trading are typically classified as income from unlisted derivatives and are subject to the progressive income tax rate.

- Crypto disposals also occur. Realized capital gains from these transactions are taxed at a fixed rate of 27.5%.

Mining

<div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>27,5% on inflow</div></div> <div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>27,5% on sale</div></div>

It's important to differentiate whether mining is conducted privately or commercially. If used for private purposes, gains are taxed at a rate of 27.5% upon receipt. Any subsequent increase in value at the time of sale is also taxed at 27.5%.

<div fs-richtext-component="info-box" class="info-box"><div class="flex-info-card"><img src="https://assets-global.website-files.com/65098a145ece52db42b9c274/650c6f4cef4c34160eab4440_Info.svg" loading="lazy" width="64" height="64" alt="" class="icon-info-box"><div fs-richtext-component="info-box-text" class="info-box-content"><p class="color-neutral-800">Note: Determining whether activity is private or commercial depends on individual circumstances. High transaction volume or value does not necessarily imply commercial activity.</p></div></div></div>

Staking

<div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>27,5% on sale</div></div>

Staking rewards are not considered income and their acquisition costs are set at zero. Therefore, there is no tax at receipt. However, if you later sell the staking rewards, you must apply a tax rate of 27.5%.

Example: If you earned €500 in ETH from staking in May 2022, and the value of this cryptocurrency doubles and you sell, you must tax these €1,000 at 27.5%.

<div fs-richtext-component="info-box" class="info-box"><div class="flex-info-card"><img src="https://assets-global.website-files.com/65098a145ece52db42b9c274/650c6f4cef4c34160eab4440_Info.svg" loading="lazy" width="64" height="64" alt="" class="icon-info-box"><div fs-richtext-component="info-box-text" class="info-box-content"><p class="color-neutral-800">Important: Staking rewards are not taxed at receipt only if they come from traditional staking, where your cryptocurrencies are used for transaction processing (block creation or validation). The general rule is that on-chain transactions are conducted directly on the blockchain. However, if “staking” offers from platforms or exchanges that operate off-chain are used, then it is considered lending. Your rewards are then taxable at the time of receipt.</p></div></div></div>

Lending

<div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>27,5% on inflow</div></div> <div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>27,5% on sale</div></div>

Taxes are incurred both at the time of receipt and upon any later value increase at sale, with the tax rate being 27.5% in both instances.

Borrowing

<div fs-richtext-component="tax-status-tax-free" class="tax-status-pills tax-free"><div>Tax Free</div></div>

Borrowing does not trigger a taxable event.

Bounty and Affiliate Programs

<div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>27,5% on sale</div></div>

Participating in bounty or affiliate programs typically results in receiving free cryptocurrencies as compensation. The acquisition cost is set at zero, and taxes on gains are applied at 27.5% upon sale.

Liquidity Mining and Yield Farming

<div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>27,5% on inflow</div></div> <div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>27,5% on sale</div></div>

It's necessary to distinguish between two processes:

- Exchanging assets into a yield farming protocol or liquidity pool: These are generally considered swaps and not taxable crypto-to-crypto transactions.

- The rewards that flow to you: Whether rewards at receipt are taxed depends on whether the cryptocurrencies used are provided to other market participants. In our view, this is typically the case, thus the rewards at receipt are taxed at 27.5%. Any value increase at sale is also taxed at 27.5%.

Please note: This view on both processes depends on the individual case; if in doubt, please ask your tax advisor.

Hard and Soft Forks

<div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>27,5% on sale</div></div>

No new cryptocurrencies are received during soft forks, so there is nothing to tax. In hard forks, you do receive new cryptocurrencies but since they are valued at zero upon receipt, no taxes are charged. At sale, a tax rate of 27.5% applies to any gains.

NFTs

<div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>Progressive Income Tax</div></div> <div fs-richtext-component="tax-status-tax-free" class="tax-status-pills tax-free"><div>Tax Free</div></div>

NFTs are not covered under current law and do not fall under the definition of a cryptocurrency, so different rules apply:

- If you hold NFTs for more than one year (365 days), your gains are tax-free.

- If you sell NFTs within a year, you pay a progressive income tax rate of 0 to 55% on gains.

- The same applies for NFT trades: Gains are tax-free after a year; otherwise, gains are taxed at a progressive rate of 0 to 55%.

<div fs-richtext-component="info-box" class="info-box"><div class="flex-info-card"><img src="https://assets-global.website-files.com/65098a145ece52db42b9c274/650c6f4cef4c34160eab4440_Info.svg" loading="lazy" width="64" height="64" alt="" class="icon-info-box"><div fs-richtext-component="info-box-text" class="info-box-content"><p class="color-neutral-800">Note: There is still a tax exemption limit of 440€ for NFTs. Gains below this threshold remain tax-free within a year. However, if your gain exceeds this limit by even one euro, you must tax the entire gain at the progressive income tax rate.</p></div></div></div>

Play to Earn

<div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>27,5% on inflow</div></div> <div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>27,5% on sale</div></div>

Play to Earn rewards are taxed at 27.5% at both receipt and upon the sale of any value increase.

Learn to Earn

<div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>27,5% on inflow</div></div> <div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>27,5% on sale</div></div>

Learn to Earn rewards are taxed at 27.5% both at receipt and the sale of any value increase.

Transaction Fees

<div fs-richtext-component="tax-status-tax-free" class="tax-status-pills tax-free"><div>Tax Deductable</div></div>

You can deduct transaction fees, such as gas fees, as allowable expenses and offset them against your gains. Note that Blockpit already includes these fees as acquisition-related costs, so they are considered in the actual gain and do not need to be listed separately in the tax return. In transactions involving both an outgoing asset and a fee, the fee is allocated according to the FIFO principle based on the outgoing asset.

Crypto Tax FAQ

Does the Austrian Federal Ministry of Finance know if I hold or trade cryptocurrencies?

Yes. The Ministry closely cooperates with existing crypto exchanges, which release Know Your Customer (KYC) data to ensure compliance with Austrian regulations. Additionally, the EU Commission's DAC-8 directive enables the Ministry to more easily verify cryptocurrency ownership.

What happens if I don't pay taxes on my crypto gains?

Depending on the severity of the tax evasion, consequences in Austria can range from tax repayments and hefty fines to imprisonment. In cases of suspicion, financial authorities can investigate up to 10 years retrospectively. For transparency and accountability, it's advisable to document all crypto transactions from recent years.

How is Bitcoin (BTC) taxed?

If you exchange Bitcoin for fiat money like the Euro and make a profit, a 27.5% tax is levied on the gain. However, crypto-to-crypto exchanges remain tax-free.

How is Ethereum (ETH) taxed?

Similar to Bitcoin, if you exchange Ethereum for fiat and realize gains, these are taxed at 27.5%. Crypto-to-crypto transactions remain tax-free.

Do I need to declare my entire crypto holdings or just my gains in my tax return?

No, you only need to declare your gains or losses and report income from cryptocurrencies, not your entire holdings.

Do I also have to pay taxes on crypto gains that date back several years?

Yes. You should keep records of your cryptocurrency transactions from the last 10 years as there's always a chance of being audited. With the volatile nature of cryptocurrencies, amounts can quickly accumulate. Using Blockpit's crypto tax software, which automatically documents the date, value in Euros, purpose, and recipient of transactions, simplifies this documentation process.

Can I pay taxes with cryptocurrencies?

No, currently, it is not possible to pay taxes with cryptocurrencies in Austria.

In which countries are cryptocurrencies tax-free?

Currently, countries like Portugal, Singapore, Malta, and Switzerland are considered very crypto-friendly for individuals.

Are there benefits to moving to another country?

If you relocate to a non-EU/EWR country like Thailand or Mexico, your crypto assets must be taxed beforehand. However, if you move to an EU or EWR country, you only need to pay taxes when you dispose of your assets.

When am I considered a commercial investor?

The distinction between private and commercial investors lies in the nature of their investments, such as making investments on behalf of others for commercial investors. Crypto tax advisor Brameshuber notes that determining whether an activity is private or commercial often depends on the specifics of the case. High transaction numbers or values alone do not necessarily qualify as commercial activity.

Since most crypto users act privately, this guide is aimed at individuals.

Helpful Links

01/2026: Update for 2026

01/2025: Update for 2025

07/2024: Complete revision; new structure, texts and images

02/2024: Update for 2024 / New tax forms / Information about the average cost basis (ACB)