Worried about tax mistakes?

Optimize your crypto taxes before year-end

Turn actionable insights into smarter decisions

Withdraw crypto stress-free

Do I Have to Pay Taxes on Cryptocurrencies in Germany?

Yes, gains and income from cryptocurrencies must be taxed in Germany.

Both cryptocurrency gains and income are subject to income tax. Additionally, you can benefit from the one-year holding period and tax exemptions for cryptocurrencies.

<div fs-richtext-component="info-box" class="info-box"><div class="flex-info-card"><img src="https://assets-global.website-files.com/65098a145ece52db42b9c274/650c6f4cef4c34160eab4440_Info.svg" loading="lazy" width="64" height="64" alt="" class="icon-info-box"><div fs-richtext-component="info-box-text" class="info-box-content"><p class="color-neutral-800">In Germany, cryptocurrencies are considered "andere Wirtschaftsgüter" similar to collectibles (like paintings, wine, or gold) and personal possessions, under § 23 EStG.</p></div></div></div>

Compared to other countries, Germany offers several tax advantages for crypto investors.

This guide assumes that you are dealing with cryptocurrencies as a private individual.

What Are the Tax Rates on Cryptocurrencies?

The income tax rate for cryptocurrencies in Germany ranges from 0% to 45%. The actual tax rate depends on your total taxable income. Additionally, a solidarity surcharge of 5.5% applies, but only if you owe more than 18,130€ in income tax for 2024.

Income Tax Rates for the Tax Year 2024 & 2025:

<figure class="block-table">

<table>

<tr>

<th>Income (2024)</th>

<th>Income (2025)</th>

<th>Steuersatz</th>

</tr>

<tr>

<td>Up to 11.784€</td>

<td>Up to 12.084€</td>

<td>0%</td>

</tr>

<tr>

<td>Up to 17.005€</td>

<td>Up to 17.430€</td>

<td>14 - 24%</td>

</tr>

<tr>

<td>Up to 66.760€</td>

<td>Up to 68.430€</td>

<td>24 - 42%</td>

</tr>

<tr>

<td>Up to 277.825€</td>

<td>Up to 277.825€</td>

<td>42%</td>

</tr>

<tr>

<td>Over 277.826€</td>

<td>Over 277.826€</td>

<td>45%</td>

</tr>

</table>

</figure>

In general, the higher the total income, the higher the average tax rate. This is referred to as a progressive tax rate.

What Does the One-Year Holding Period Mean for Crypto?

In Germany, cryptocurrencies can be sold tax-free after a one-year holding period. This period is also known as the one-year speculative period according to § 23 Abs. 1 Nr. 2 S. 1 EStG.

<div fs-richtext-component="info-box" class="info-box"><div class="flex-info-card"><img src="https://assets-global.website-files.com/65098a145ece52db42b9c274/650c6f4cef4c34160eab4440_Info.svg" loading="lazy" width="64" height="64" alt="" class="icon-info-box"><div fs-richtext-component="info-box-text" class="info-box-content"><p class="color-neutral-800">It's important to note that any form of disposal counts as a "sale," including the exchange of one cryptocurrency for another. </p></div></div></div>

Example: If you purchased Bitcoin on January 1, 2024, a tax-free sale would be possible starting January 2, 2025!

What Are the Exemption Limits for Cryptocurrencies?

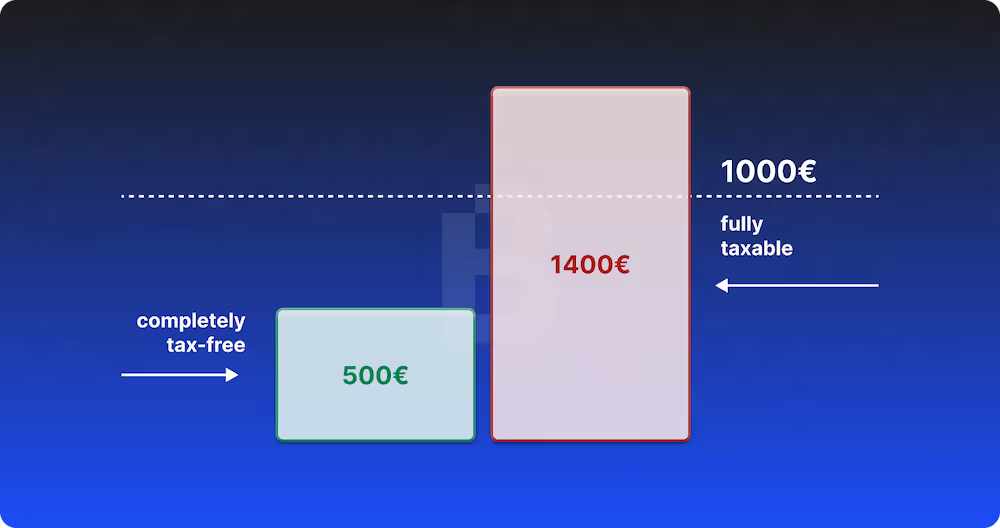

Gains from trading cryptocurrencies are tax-free up to an exemption limit of 1000€ per year. This limit applies from the 2024 tax year onward; for previous years, the allowance is 600€. Crypto income, such as from staking or lending, is tax-free up to an exemption limit of 256€ per year.

<div fs-richtext-component="info-box" class="info-box warning"><div class="flex-info-card"><img src="https://assets-global.website-files.com/65098a145ece52db42b9c274/650c6f473e84badfdd6e059e_Care.svg" loading="lazy" width="64" height="64" alt="" class="icon-info-box"><div fs-richtext-component="info-box-text" class="info-box-content"><p class="color-neutral-800">These are exemption limits under § 23 EStG for gains and § 22 EStG for income, not allowances! Once you exceed these limits, the entire amount becomes taxable.</p></div></div></div>

How Do I Calculate Crypto Gains for the Tax Return?

Crypto gains are calculated from the difference between the acquisition cost and the selling price. If the result is positive, you have made a gain. If the result is negative, you have incurred a loss.

Example Calculation 1:

You buy BTC worth 1,400€.

A few weeks later, you sell the BTC for 2,200€.

You've made a profit of 800€!

Example Calculation 2:

You buy BTC worth 1,400€.

A few weeks later, you sell the BTC for 1,200€.

You've incurred a loss of 200€!

<div fs-richtext-component="info-box" class="info-box protip"><div class="flex-info-card"><img src="https://assets-global.website-files.com/65098a145ece52db42b9c274/650c6f4b151815fb0be48cec_Lightning.svg" loading="lazy" width="64" height="64" alt="" class="icon-info-box"><div fs-richtext-component="info-box-text" class="info-box-content"><p class="color-neutral-800">You can claim crypto losses on your taxes to offset other crypto gains and reduce your tax burden—even retroactively for the previous tax year!</p></div></div></div>

There are various methods to determine the acquisition costs of cryptocurrencies. This is particularly important if you have purchased cryptocurrencies at different times and prices. According to German interpretation, the First-in-First-out (FiFo) method is most suitable for calculating gains.

Use our popular crypto tax calculator to automatically calculate your gains and losses.

How Do I Calculate Crypto Income for Tax Returns?

Crypto income is calculated at the time of receipt. Simply take the value of the cryptocurrency at the moment you received it.

Our crypto portfolio tracker helps you keep track of all expenses and incomes on your wallets and automatically records the relevant values. This saves a lot of time and stress when calculating taxes.

How Can I Optimize My Crypto Taxes?

1. Use Tax Loss Harvesting: Sell cryptocurrencies that have decreased in value to offset gains from other investments. This reduces your taxable income and is particularly effective at year-end when you have a clearer view of your annual performance.

2. Leverage the Holding Period: In Germany, cryptocurrencies held for over one year can be sold tax-free. This rule makes long-term investments especially appealing.

3. Maximize Allowances:

- For private sales, a 1,000€ exemption applies from tax year 2024. Gains below this amount are tax-free, but exceeding it makes the entire gain taxable.

- Income from staking, mining, or lending is tax-free up to 256€ per year under § 22 EStG. Earnings above this are taxed at your personal income tax rate.

4. Use Crypto Tax Software: Tools like Blockpit help you keep track of all transactions and simplify tax reporting. The Crypto Tax Optimizer, part of Blockpit Plus, streamlines the process of Tax Loss Harvesting.

When Is the Best Time for Tax Loss Harvesting?

The ideal time for Tax Loss Harvesting is at the end of the year when you can evaluate your portfolio’s annual performance. Identify cryptocurrencies that have lost value and sell them strategically to realize losses. These losses can then offset gains from other investments, reducing your tax burden.

Important: Losses must be realized within the same tax year. To optimize your 2025 taxes, ensure you complete your Tax Loss Harvesting by December 31, 2025.

<div fs-richtext-component="info-box" class="info-box protip"><div class="flex-info-card"><img src="https://assets-global.website-files.com/65098a145ece52db42b9c274/650c6f4b151815fb0be48cec_Lightning.svg" loading="lazy" width="64" height="64" alt="" class="icon-info-box"><div fs-richtext-component="info-box-text" class="info-box-content"><p class="color-neutral-800">Pro Tip: Tools like the Crypto Tax Optimizer, part of Blockpit Plus, can help you uncover hidden opportunities in your portfolio and efficiently reduce your tax liability. Don’t miss out!</p></div></div></div>

How to File a Tax Return for Cryptocurrencies

Filing your cryptocurrency tax return is part of your annual income tax return submitted to your local tax office. You can submit the income tax return using the ESt 1 A form, either on paper with official forms or electronically via the Elster Portal.

<div fs-richtext-component="info-box" class="info-box warning"><div class="flex-info-card"><img src="https://assets-global.website-files.com/65098a145ece52db42b9c274/650c6f473e84badfdd6e059e_Care.svg" loading="lazy" width="64" height="64" alt="" class="icon-info-box"><div fs-richtext-component="info-box-text" class="info-box-content"><p class="color-neutral-800">Even if you are not normally required to submit a tax return, taxable gains and income from cryptocurrencies must be reported to the tax office.</p></div></div></div>

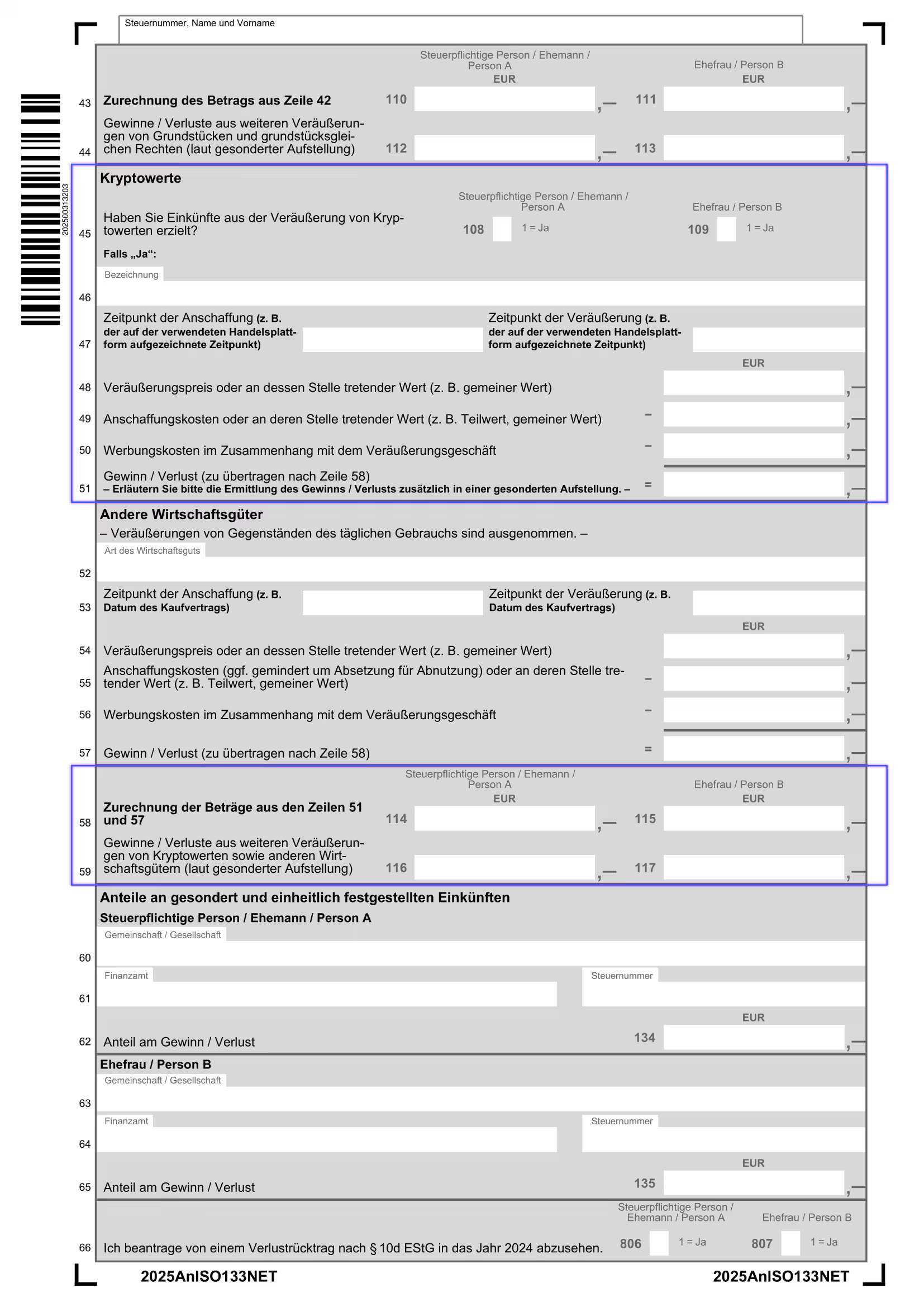

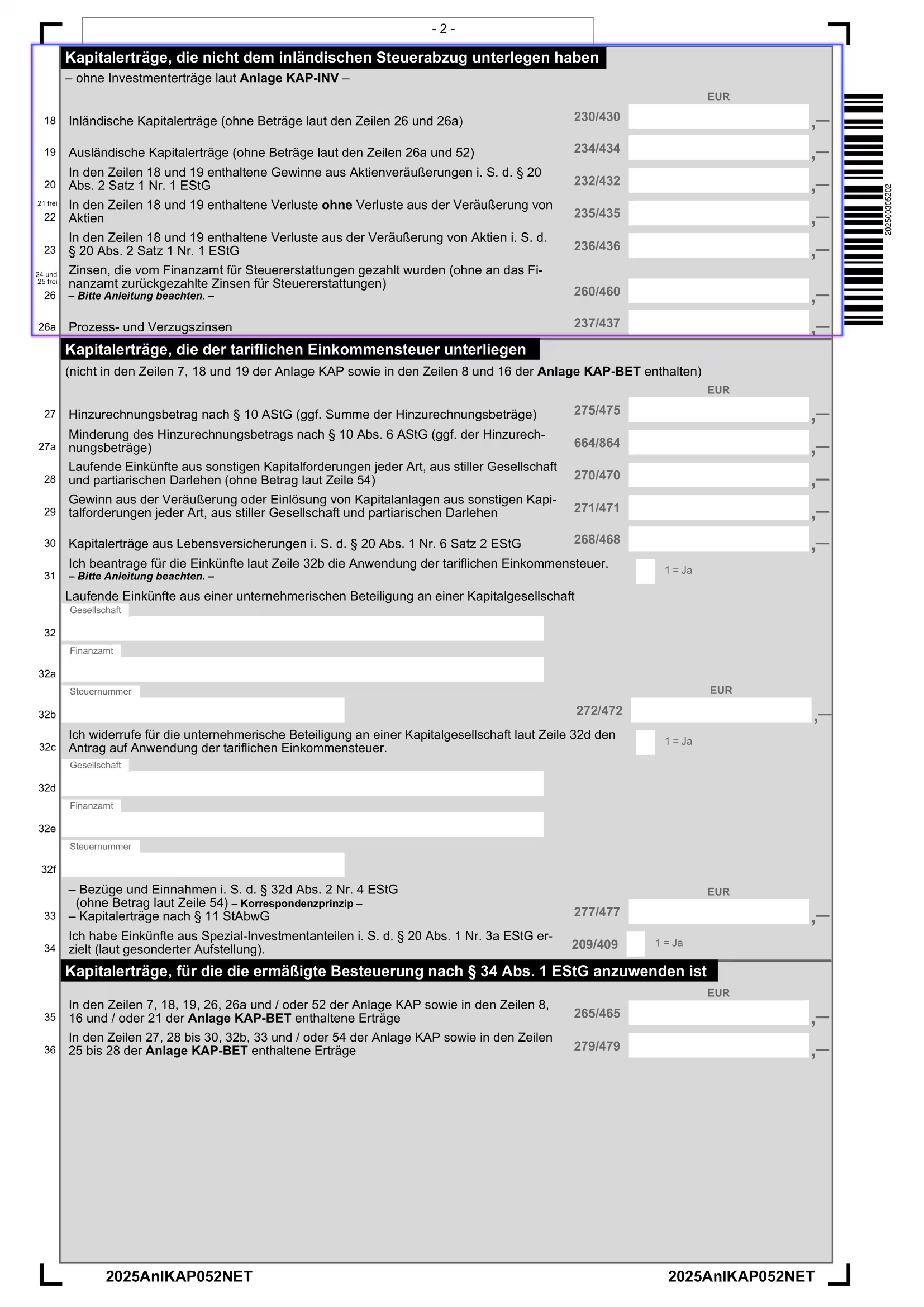

For the 2025 tax year, there are specific sections in the Anlage SO form dedicated to "Kryptowerte".

Entering crypto gains and losses in your tax return

Gains from the sale of cryptocurrencies must be reported on form ESt 1 A, in Anlage SO.

On page 2 of Annex SO, you will find the section “Kryptowerte”.

The “Kryptowerte” section is used for the first time in the tax return for the 2025 tax year. In previous tax returns, gains and losses from cryptocurrencies had to be reported in the section “Einheiten virtueller Währungen und / oder sonstige Token”.

Line 45: Enter 1 in box 108 if you earned income from the sale of cryptocurrencies. Box 109 is for spouses.

Line 46: Enter “cryptocurrencies” or the specific name of a cryptocurrency. If you carried out multiple different transactions, you can refer to the Blockpit tax report, which you can submit together with your tax return.

Line 47: Enter the date of acquisition and disposal. If there were multiple transactions, you can also simply enter the full period from 01/01/2023 to 31/12/2023.

Line 48: Enter the total disposal proceeds of all cryptocurrencies sold.

Line 49: Enter the total acquisition costs of all cryptocurrencies sold.

Line 50: Enter all expenses related to the purchase or sale, such as transaction fees.

<div fs-richtext-component="info-box" class="info-box"><div class="flex-info-card"><img src="https://assets-global.website-files.com/65098a145ece52db42b9c274/650c6f4cef4c34160eab4440_Info.svg" loading="lazy" width="64" height="64" alt="" class="icon-info-box"><div fs-richtext-component="info-box-text" class="info-box-content"><p class="color-neutral-800">Blockpit automatically deducts transaction fees from the gain, so they should not be entered again here.</p></div></div></div>

Line 51: Subtract the acquisition costs (line 49) and expenses (line 50) from the disposal proceeds (line 48). The result is your gain or loss.

Line 58: Enter the amount from line 51 in box 114. Box 115 is for spouses.

Line 59: Gains or losses from other disposals, such as the sale of art or gold, must be entered in box 116. Box 117 is for spouses.

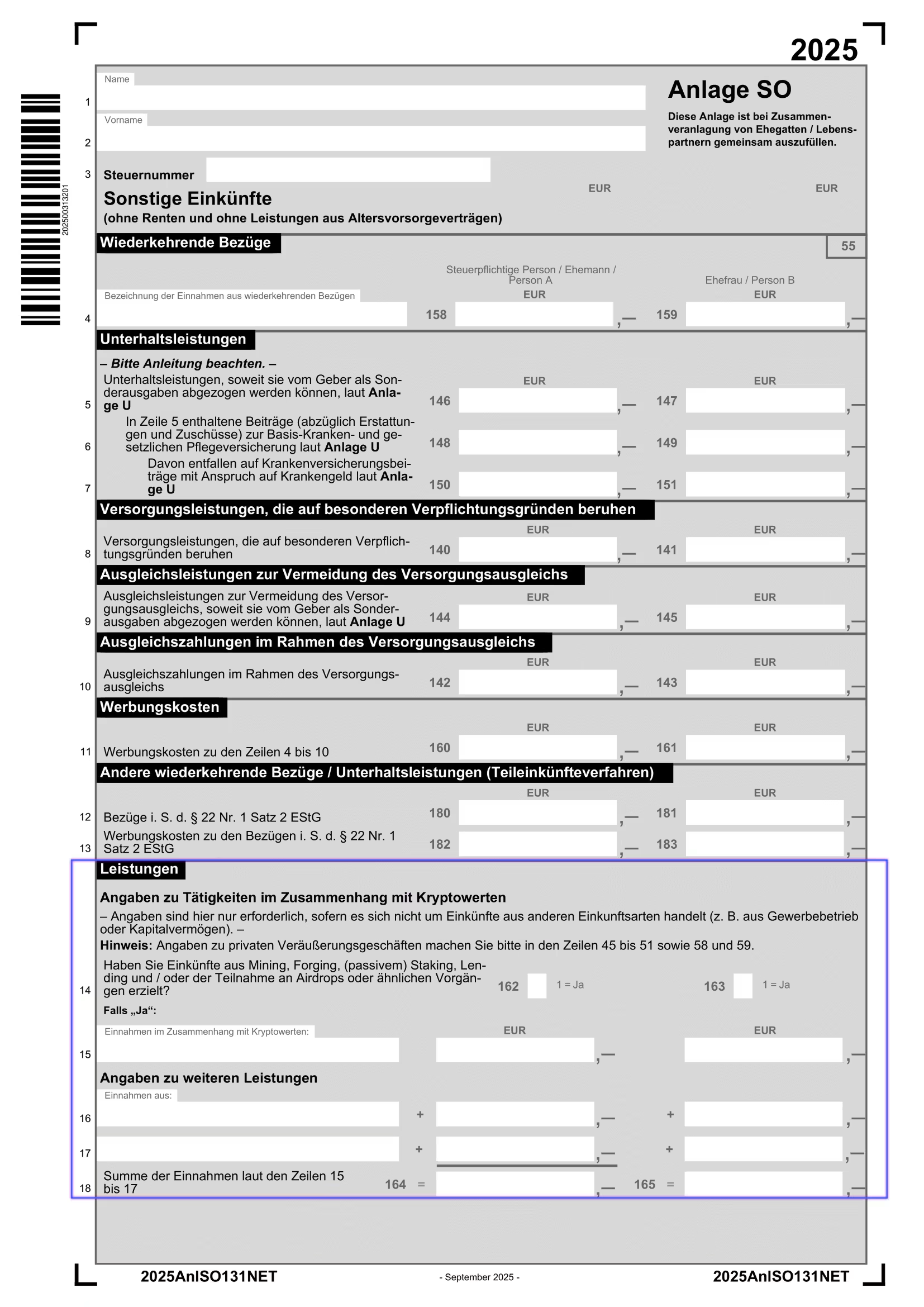

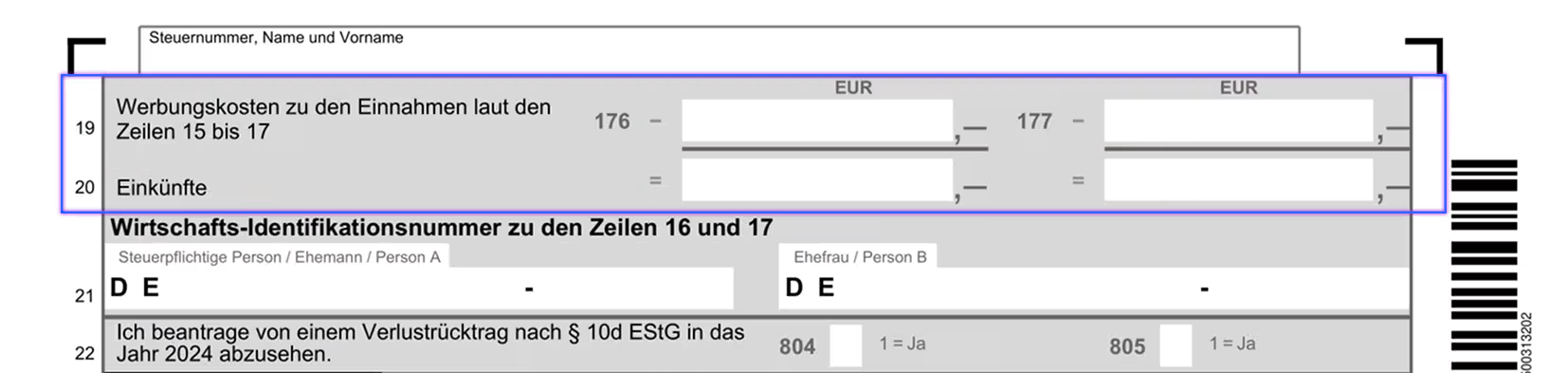

Entering crypto income in the tax return

Crypto income generated from staking, mining, lending, airdrops, or other activities must also be declared in Form ESt 1 A, in Annex SO. On page 1 of Annex SO, you will find the section “Leistungen - Angaben zu Tätigkeiten im Zusammenhang mit Kryptowerten”.

Line 14: Enter a 1 in box 162 if you earned income from cryptocurrencies.

Line 15: On the left, specify the type of income and enter the amount on the right. If you have multiple types of crypto income, you can refer to your Blockpit tax report here and submit it as an attachment. Blockpit automatically totals all income in line 15.

Lines 16 + 17: Enter additional types of income here, if applicable.

Line 18: Add up all amounts from lines 15, 16, and 17.

Line 19: Enter any deductible expenses related to earning this income.

Line 20: Enter the calculated income (line 18 minus line 19).

Crypto derivatives in the tax return

If you earned income from crypto derivatives (futures), these must be declared in Annex KAP for investment income.

Lines 19 and 20: Enter profits from derivative transactions here.

Line 22: Enter losses from derivative transactions here.

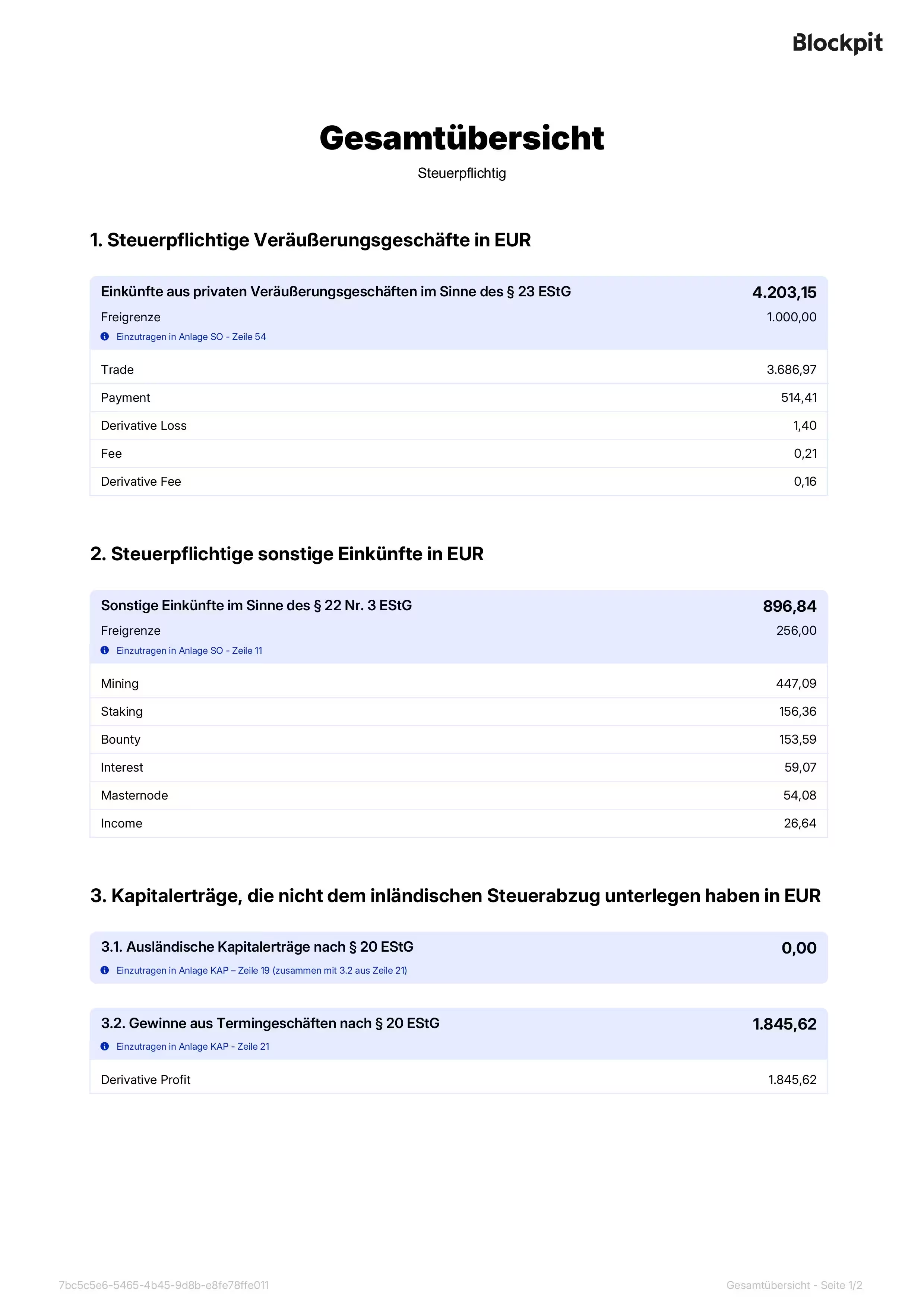

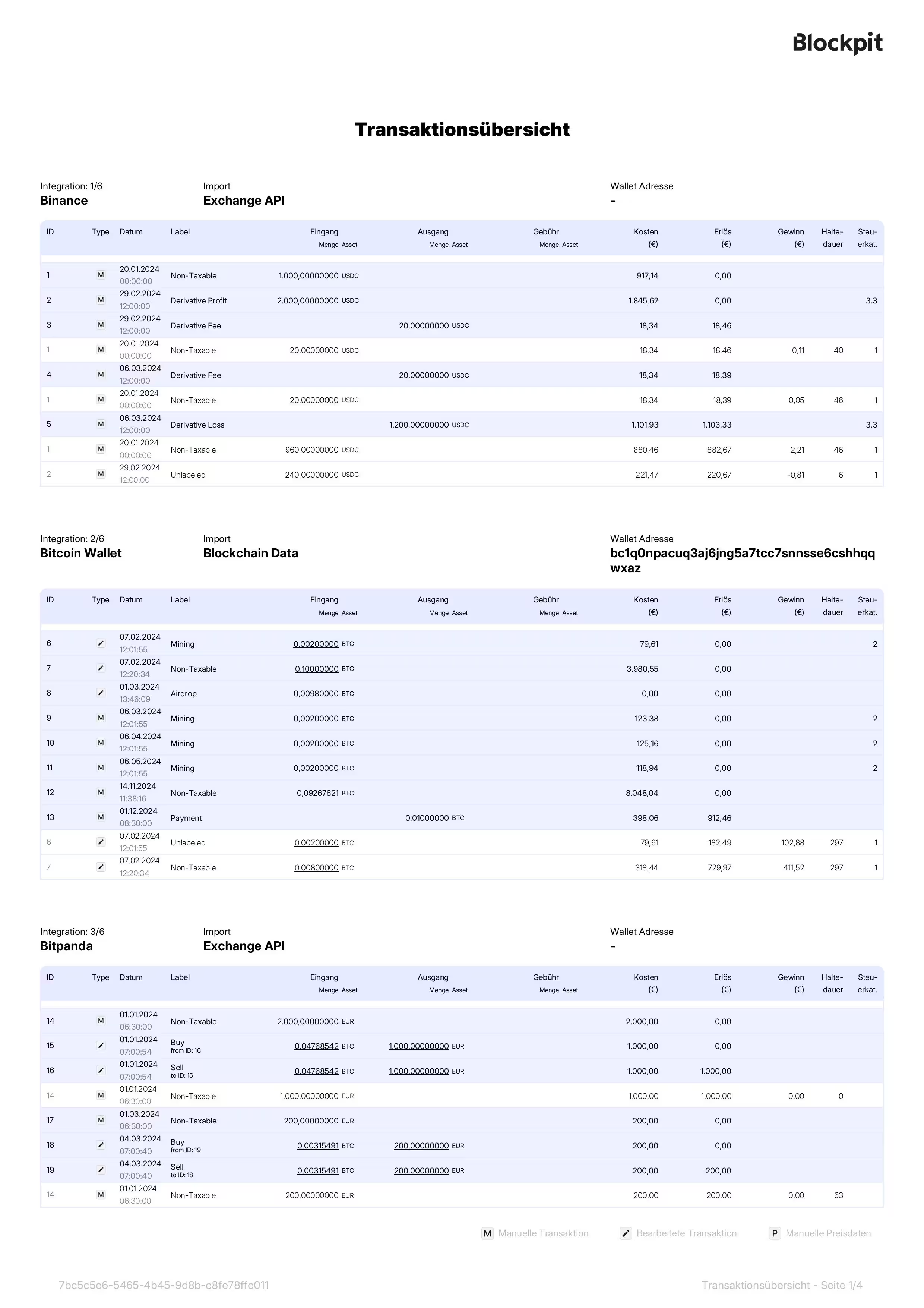

Your Crypto Tax Report with Blockpit

Quickly and easily create your personal crypto tax report with the Blockpit crypto tax calculator, available as a convenient PDF.

Blockpit adheres to German tax regulations, ensuring all your transactions are legally categorized and assigned correctly.

In addition to pre-filled tax forms, Blockpit also generates a detailed transaction report listing all tax-relevant transactions, which can be presented to the tax office upon request.

Want to see every detail? Here's the complete PDF of our sample crypto tax report.

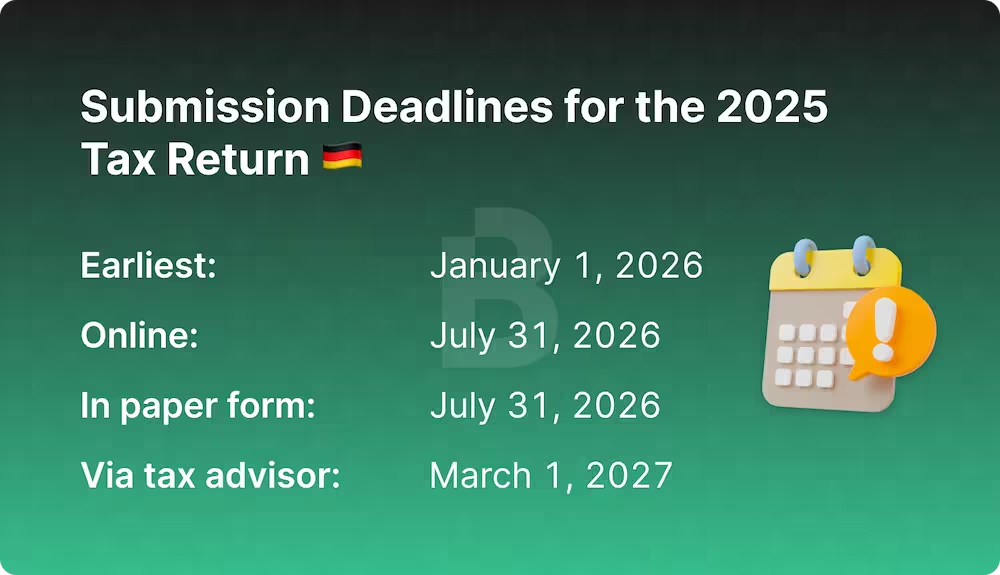

When Is the Tax Return Due?

The deadline for the 2025 tax return is July 31, 2026. This applies to both online and paper submissions.

If you have your tax return prepared by tax advisors, the deadline extends to March 1, 2027.

<div fs-richtext-component="info-box" class="info-box protip"><div class="flex-info-card"><img src="https://assets-global.website-files.com/65098a145ece52db42b9c274/650c6f4b151815fb0be48cec_Lightning.svg" loading="lazy" width="64" height="64" alt="" class="icon-info-box"><div fs-richtext-component="info-box-text" class="info-box-content"><p class="color-neutral-800">Tax advisors also appreciate Blockpit's tax reports! They save a lot of work—and save you money!</p></div></div></div>

When Do Crypto Taxes Apply?

Selling Cryptocurrencies

<div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>Income Tax Rate 0-45%</div></div>

Selling or withdrawing cryptocurrencies in exchange for fiat currencies like the Euro or Dollar is taxable if sold within the one-year holding period.

Selling crypto outside the holding period or with a total annual profit under 1000€ is tax-free.

Spending Cryptocurrencies

<div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>Income Tax Rate 0-45%</div></div>

Using cryptocurrencies to pay for goods or services is treated tax-wise as a sale. The sales value is the exchange rate at the time of payment.

Exchanging Cryptocurrencies

<div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>Income Tax Rate 0-45%</div></div>

Exchanging one cryptocurrency for another (e.g., BTC → ETH) can trigger a tax liability if you realize over 1000€ in profit and this profit is realized within 365 days from the original purchase.

Trading with Stablecoins

<div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>Income Tax Rate 0-45%</div></div>

Stablecoins are cryptocurrencies typically pegged to a traditional fiat currency, like the US Dollar (TrueUSD) or the Euro (EURB).

Tax-wise, however, they are treated the same as other cryptocurrencies. Sales are taxable if done within a year of acquisition and with more than 1000€ total profit per year.

Airdrops

<div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>Income Tax Rate 0-45% at disposal</div></div>

Airdrops do not need to be taxed upon receipt, provided they are not distributed in return for a specific activity.

The acquisition costs are then 0€.

Normal tax rules apply again upon disposal of the airdrop if the holding period is less than a year and the total profit exceeds 1000€.

Bitpanda BEST Rewards

<div fs-richtext-component="tax-status-tax-free" class="tax-status-pills tax-free"><div>Tax Free</div></div>

When the word "airdrop" is mentioned, many immediately think of Bitpanda BEST Rewards. So, does this mean BEST Rewards also need to be taxed? We've looked into the situation more closely.

The Bitpanda loyalty program is becoming increasingly popular, especially among new crypto users, often serving as their first encounter with a crypto reward token or airdrop. As a result, we at Blockpit receive many inquiries about potential taxation. Crypto tax advisor Georg Brameshuber clarifies the situation:

"The mere use of a platform should not lead to a taxable airdrop, for the following reason: Simply using a platform does not constitute 'active engagement' in the sense of a compensatory action. Rather, it is merely the use of a service. Therefore, the allocation of Bitpanda BEST Rewards is not taxable, as no compensation is involved. Consequently, it is considered to have a value of 0€ upon receipt, with no tax liability."

Bounties

<div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>Income Tax Rate 0-45%a at receipt</div></div>

<div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>Income Tax Rate 0-45% at disposal</div></div>

Unlike airdrops, a service must be performed for a bounty. Thus, bounties are taxable at the progressive income tax rate upon receipt.

Any gain is also taxable if sold within 365 days. After the one-year holding period, the sale is naturally tax-free.

NFTs (Non-Fungible Tokens)

<div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>Income Tax Rate 0-45%</div></div>

From a tax perspective, buying or selling an NFT is considered a token exchange, meaning the profit is taxed in Germany at the progressive income tax rate and is tax-free after a one-year holding period.

DeFi (Decentralized Finance)

<div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>Income Tax Rate 0-45%</div></div>

The ability to generate rewards and thus passive income with cryptocurrencies is extremely popular. Here's how they are taxed:

Revenues from DeFi activities are defined as acquisition transactions in the 2022 BMF letter. The acquisition costs correspond to the market rate at the time of acquisition. If the rewards are later sold, this is taxable within the one-year holding period.

Staking

<div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>Income Tax Rate 0-45%</div></div>

Income from staking is subject to taxation as part of private asset management under § 22 No. 3 EStG, meaning staking rewards must be declared as other income in the tax return.

Staking rewards are taxed at the personal income tax rate upon receipt if the total income from cryptocurrencies is less than 256€ per year.

Lending

<div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>Income Tax Rate 0-45%</div></div>

Rewards from lending are also taxed at the personal income tax rate upon receipt.

The exemption limit for other income of a maximum of 256€ per year also applies to income from lending.

If the rewards are later sold, this is taxable within the one-year holding period.

Mining

<div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>Income Tax Rate 0-45%</div></div>

Mining rewards are taxed at the personal income tax rate upon receipt.

If the rewards are sold later, taxes apply within the one-year holding period.

Also note the exemption limit for other income of a maximum of 256€ per year.

It is important here to classify the activity as private!

Mining rewards from commercial activity are considered commercial income.

ICOs & IEOs

<div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>Income Tax Rate 0-45%</div></div>

Tax-wise, buying ICOs and IEOs is comparable to crypto trades. Here too, the values at the time of purchase and sale are compared.

These events are only taxable if sold within a year (365 days) and a profit of over 1000€ is made.

Margin Trading with Cryptocurrencies

<div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>Capital Gains Tax 25%</div></div>

Margin trading, or trading with borrowed capital, is classified as a futures transaction. This leads to income from margin trading being subject to a flat tax rate of 25% capital gains tax.

The tax benefits of the one-year holding period or exemption limit cannot be applied to capital income.

Trading with Futures

<div fs-richtext-component="tax-status-income-tax" class="tax-status-pills"><div>Capital Gains Tax 25%</div></div>

Future trading also falls under the classification of a futures transaction, as the subject of the futures transaction is not the cryptocurrency, but the difference settlement.

Income from trading with futures is thus subject to a flat tax rate of 25% capital gains tax.

Again, the tax-favorable one-year holding period cannot be applied here.

<div fs-richtext-component="info-box" class="info-box warning"><div class="flex-info-card"><img src="https://assets-global.website-files.com/65098a145ece52db42b9c274/650c6f473e84badfdd6e059e_Care.svg" loading="lazy" width="64" height="64" alt="" class="icon-info-box"><div fs-richtext-component="info-box-text" class="info-box-content"><p class="color-neutral-800">If cryptocurrencies are delivered in futures, it constitutes a private sale.</p></div></div></div>

When Are Crypto Taxes Not Applicable?

Purchasing Cryptocurrencies

<div fs-richtext-component="tax-status-tax-free" class="tax-status-pills tax-free"><div>Tax Free</div></div>

Buying cryptocurrencies with fiat money, like the Euro, is not taxable.

Account Transfers

<div fs-richtext-component="tax-status-tax-free" class="tax-status-pills tax-free"><div>Tax Free</div></div>

Moving crypto within your own wallets or to/from an exchange is also tax-free. It's important to keep accurate records to prove these transfers if needed.

Gifting or Donating Cryptocurrencies

<div fs-richtext-component="tax-status-tax-free" class="tax-status-pills tax-free"><div>Tax Free</div></div>

You can gift up to 20,000€ per year tax-free (e.g., to acquaintances) without considering the one-year holding period. For spouses, the limit is 500,000€. These exemption limits are subject to a 10-year period!

Crypto donations are also tax-free.

<div fs-richtext-component="info-box" class="info-box"><div class="flex-info-card"><img src="https://assets-global.website-files.com/65098a145ece52db42b9c274/650c6f4cef4c34160eab4440_Info.svg" loading="lazy" width="64" height="64" alt="" class="icon-info-box"><div fs-richtext-component="info-box-text" class="info-box-content"><p class="color-neutral-800">The one-year holding period transfers to the recipient in the case of a gift.</p></div></div></div>

Swapping Cryptocurrencies

<div fs-richtext-component="tax-status-tax-free" class="tax-status-pills tax-free"><div>Tax Free</div></div>

The terms “exchange” and “swap” are often used interchangeably. In a true crypto swap, coins are exchanged within a project.

Unlike an exchange, a swap is tax-neutral.

Hard Forks & Soft Forks

<div fs-richtext-component="tax-status-tax-free" class="tax-status-pills tax-free"><div>Tax Free</div></div>

The "step-in-the-shoes" theory applies to hard forks. This means no tax changes apply to the original asset.

For the newly created asset: The acquisition date of the original asset transfers to the new coins. Acquisition costs are divided according to the market value ratio.

In most cases, the newly created assets have no market value at the time of the fork, so the acquisition costs are set at 0€.

The acquisition costs remain with the units of the virtual currency existing before the hard fork.

Exchange Fees

<div fs-richtext-component="tax-status-tax-free" class="tax-status-pills tax-free"><div>Tax Deductable</div></div>

Transaction fees, like gas fees, can be claimed as expenses and offset against your gains.

However, the Blockpit Crypto Tax Calculator already accounts for transaction fees as acquisition-related costs, so they are already deducted from the profit. You do not need to list them separately in the tax return.

Cashback

<div fs-richtext-component="tax-status-tax-free" class="tax-status-pills tax-free"><div>potentially tax-free</div></div>

The tax treatment of cashback rewards in fiat currency is generally considered a discount and is not subject to income tax. This should also apply to crypto Visa cards. However, it remains disputed whether the use of these cards constitutes a "remunerative acquisition," which could affect the rules for private sales transactions under § 23 of the German Income Tax Act (EStG). Since there is no formal acquisition process, sales or payments made with these cryptocurrencies within the holding period likely do not trigger a taxable event. Nevertheless, it is recommended to disclose such transactions in your tax return to avoid potential tax law violations.

For the sake of completeness, it should be noted that crypto cashback may, in some cases, be considered as "other income," similar to rewards, from the perspective of the tax authorities. In this case, there is a risk that § 22 Nr. 3 EStG could apply.

Losses, Scams & Theft

<div fs-richtext-component="tax-status-tax-free" class="tax-status-pills tax-free"><div>Tax Deductable</div></div>

Losses from trading cryptocurrencies within the one-year holding period can offset your gains from the same, previous, or following tax year. This is referred to as loss carryforward or loss carryback.

The carryback is limited to the previous year, while the carryforward is indefinite. A loss carryback reduces the taxable income of the previous year, which can lead to a tax refund if too much tax was paid.

If you've lost cryptocurrencies due to a scam, hack, or exchange insolvency, you can declare these losses in the tax return in Anlage SO.

However, the tax office will check if this can be recognized as an actual loss.

Unfortunately, there is no guarantee and it always depends on the individual case.

Crypto Tax FAQ

Does the Tax Office Know I Own Cryptocurrencies?

Cryptocurrency trading isn't as anonymous as one might think. Authorities can track crypto transactions and link them to personal data, especially through legal pressure on crypto exchanges. New regulations like DAC8 and MiCA are further aimed at combating tax evasion involving cryptocurrencies.

Do I Need to Pay Taxes on Crypto Profits from Years Ago?

Yes. It's advisable to keep records of your cryptocurrency transactions for the past 10 years as there's a chance you might be audited. In the volatile crypto space, amounts can quickly add up. Significant tax evasion occurs when the evaded tax exceeds €50,000.

Are Cryptocurrencies Taxed Like Stocks?

No, cryptocurrencies are not taxed like stocks. Profits from stock trading are considered capital gains and are taxed at a flat rate of 25% in Germany (capital gains tax). Cryptocurrencies, however, are classified as "private economic goods." Thus, their trading profits are subject to income tax, not capital gains tax.

Can I Pay Taxes with Cryptocurrencies?

No, that is not currently possible in Germany.

In Which Countries are Cryptocurrencies Tax-Free?

Countries like Portugal, Singapore, Malta, and Switzerland are considered very crypto-friendly for individuals.

Where Can I Learn More About Cryptocurrencies and Taxes?

We have published a variety of guides on various crypto tax topics in Germany, all available here: Blockpit Crypto Tax Guides.

Our crypto experts write detailed articles and useful guides on the Blockpit Blog to help you understand crypto, make better investment decisions, and find the best crypto tools.

In the Blockpit Community, you can engage with other users and tax experts on all topics related to cryptocurrencies, taxes, and regulations. Updates from the Federal Ministry of Finance (BMF) and the Federal Central Tax Office (BZSt) on current changes are also available.

Helpful Links

January 2026: Update for 2026

July 2024: Complete revision; new structure, texts and images

February 2024: Update for 2024 / New tax forms