Track Smarter. Trade Better.

Turn actionable insights into smarter decisions

Withdraw crypto stress-free

Optimize your crypto taxes before year-end

Your bank stopped your crypto payout, asking you to prove where the money came from? You’re not alone. More and more banks and exchanges require proof of the origin of crypto assets before releasing payouts or accepting assets.

The problem: many investors don’t know what to submit — or how to present transactions in a way compliance teams understand. Screenshots, spreadsheets, and wallet IDs are often not enough.

That’s exactly where Blockpit’s new Source of Funds comes in.

Prefer watching instead of reading? Then head over here:

What is “Source of Funds”?

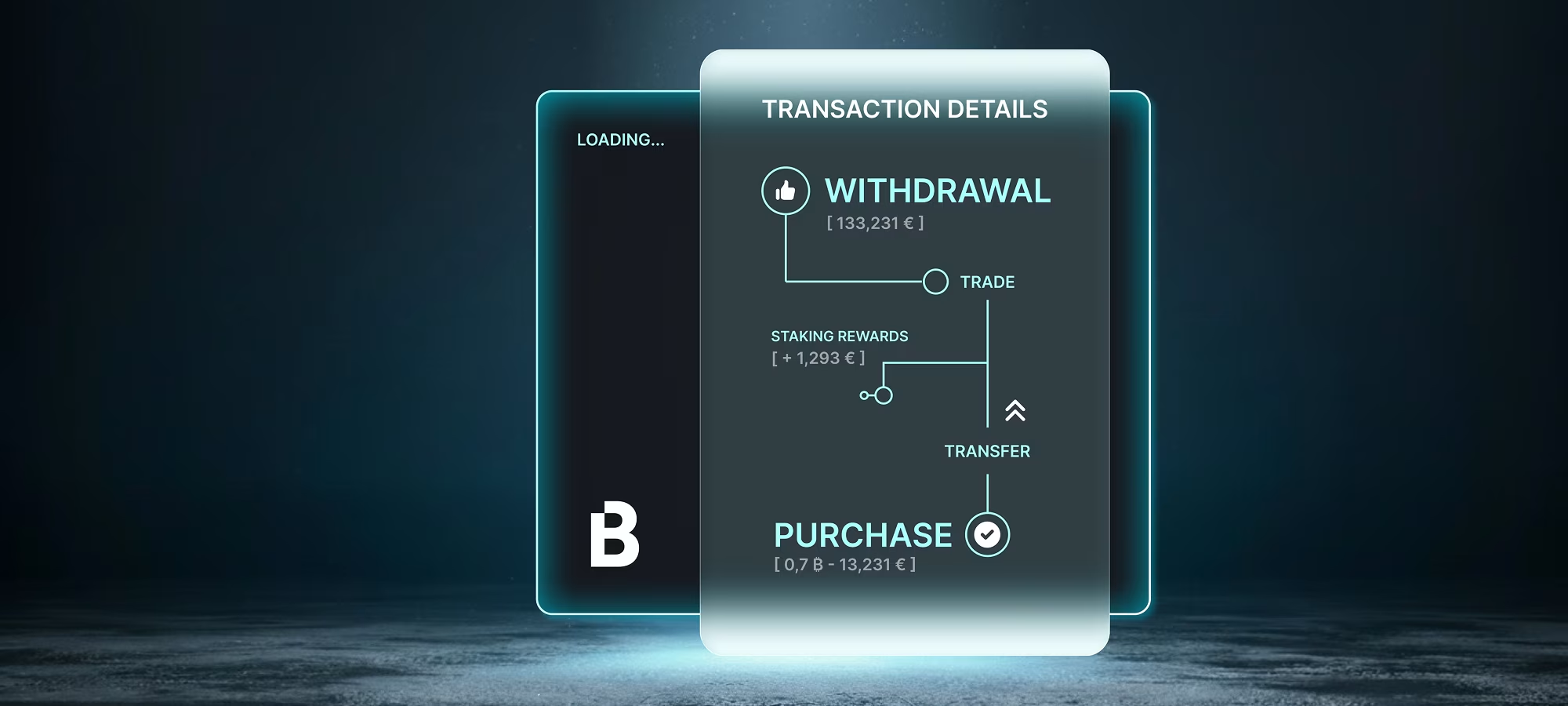

Blockpit Source of Funds creates a structured, bank-friendly proof of origin for your cryptocurrencies in just minutes.

The result is a clear PDF report showing where your crypto wealth came from, how it progressed, and when it was converted to fiat — including clean transaction-flow diagrams, timestamps, and source references.

<div fs-richtext-component="info-box" class="info-box"><div class="flex-info-card"><img src="https://assets-global.website-files.com/65098a145ece52db42b9c274/650c6f4cef4c34160eab4440_Info.svg" loading="lazy" width="64" height="64" alt="" class="icon-info-box"><div fs-richtext-component="info-box-text" class="info-box-content"><p class="color-neutral-800">In short: when the bank asks “Where did this money come from?”, Source of Funds provides the answer — clean, traceable, and easy to understand.</p></div></div></div>

The problems Source of Funds solves

1) Avoid frozen payouts

Imagine: you’ve held Bitcoin for years, the price is right, you transfer to an exchange to sell — and the transfer is halted. The exchange asks whether your coins were bought, swapped, or mined. Until you prove it, trading is blocked.

Even after selling, the next hurdle may appear: your bank. For larger amounts, it may demand proof of funds — in the worst case, your account is temporarily frozen.

Scenarios like these are increasingly common. With Blockpit Source of Funds, you have the required information ready immediately. That saves time and nerves — and helps you access your money faster.

2) Bring order to a chaotic process — save time and energy

There’s no unified standard for an origin-of-funds report. Every bank and exchange asks for different things — and even compliance teams aren’t always sure what they need.

Blockpit addresses this by working with banks, exchanges, and experts to deliver a clear, structured format that includes all key details: transaction history, sources, movements, time frames — plus an easy-to-read flow diagram.

<div fs-richtext-component="info-box" class="info-box protip"><div class="flex-info-card"><img src="https://assets-global.website-files.com/65098a145ece52db42b9c274/650c6f4b151815fb0be48cec_Lightning.svg" loading="lazy" width="64" height="64" alt="" class="icon-info-box"><div fs-richtext-component="info-box-text" class="info-box-content"><p class="color-neutral-800">Blockpit covers the hardest part — the complete crypto transaction history up to the first fiat deposit. You can simply add supporting docs like payslips or bank statements. The result: no scavenger hunt, no spreadsheet chaos — but a professional, traceable report any bank can work with.</p></div></div></div>

When you need Source of Funds

a) Your payout is already frozen (urgent)

Bank or exchange stopped a payout? Source of Funds lets you document your transactions quickly and transparently — to speed up the release of funds.

b) You’re planning a larger payout (preventive)

Create the report beforehand and submit it proactively to your bank. This helps prevent follow-up questions, delays, or freezes before they happen.

Bottom line: Preparation saves time — and lets you sleep at night.

<div fs-richtext-component="info-box" class="info-box"><div class="flex-info-card"><img src="https://assets-global.website-files.com/65098a145ece52db42b9c274/650c6f4cef4c34160eab4440_Info.svg" loading="lazy" width="64" height="64" alt="" class="icon-info-box"><div fs-richtext-component="info-box-text" class="info-box-content"><p class="color-neutral-800">If you already use Blockpit for portfolio tracking or tax reporting, most of the work is done. Source of Funds pulls directly from your existing Blockpit data — no screenshots, no spreadsheets, no chaos. One click, and your report is ready.</p></div></div></div>

Pricing & Credits

One Credit = one Source of Funds report.

Buy credits in advance, store them flexibly, and redeem anytime — they don’t expire.

Intro pricing:

- 1 Credit: €9.99

- 3 Credits: €24.99

- 5 Credits: €39.99

(Later standard price: €19.99 per credit)

Conclusion: Stay calm, create the report, secure the payout

If your bank or exchange asks for proof, there’s no need to panic.

With Blockpit Source of Funds, you can deliver a clean, understandable report in minutes — instead of losing days in data chaos.

That turns stress into control — and gets your money released faster.

<div fs-richtext-component="info-box" class="info-box protip"><div class="flex-info-card"><img src="https://assets-global.website-files.com/65098a145ece52db42b9c274/650c6f4b151815fb0be48cec_Lightning.svg" loading="lazy" width="64" height="64" alt="" class="icon-info-box"><div fs-richtext-component="info-box-text" class="info-box-content"><p class="color-neutral-800">Curious? Check out a sample report and learn in the Help Center how to create your own Source of Funds report in Blockpit — step by step.</p></div></div></div>